Copper Futures

Copper Futures Market

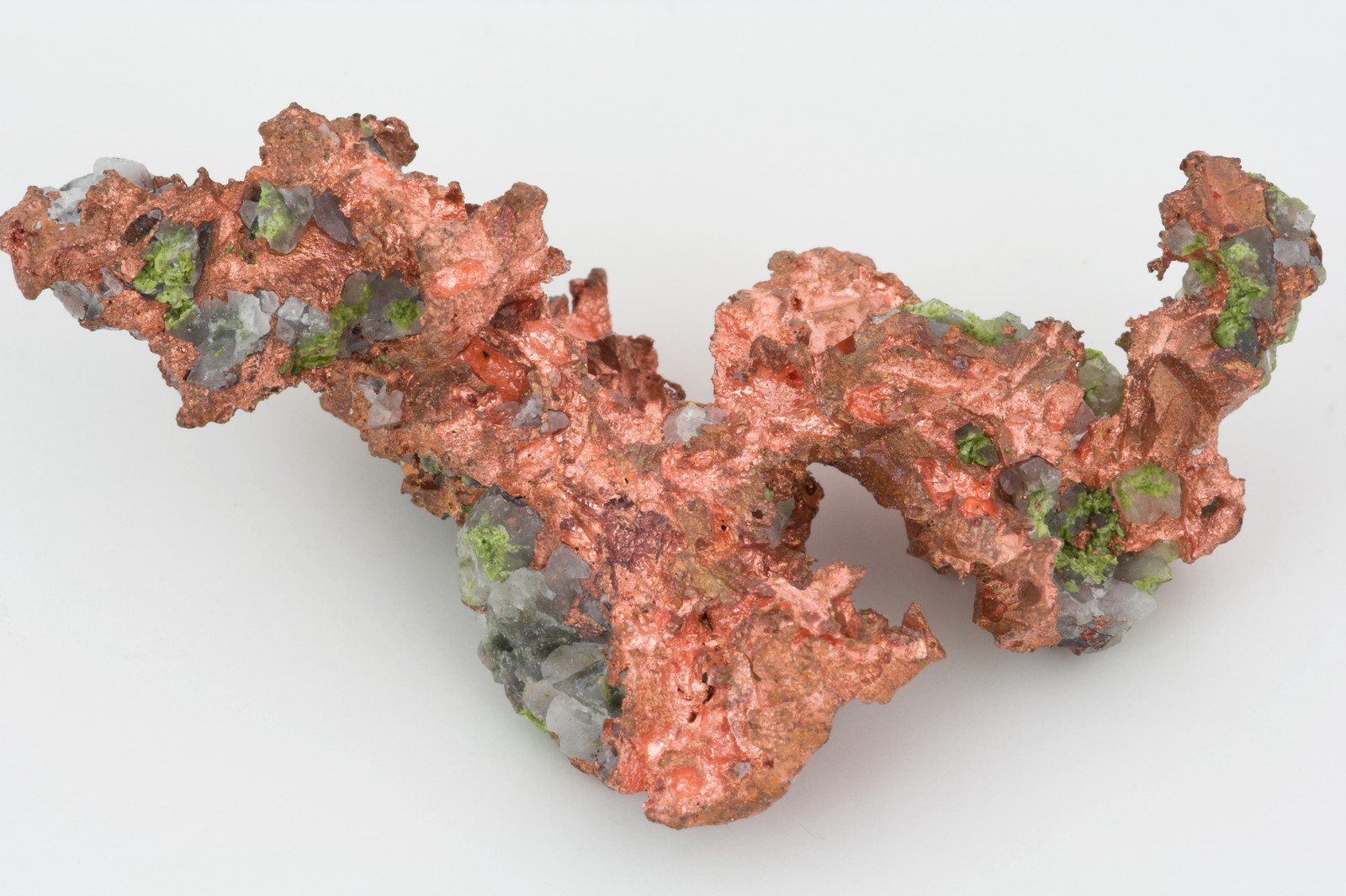

Copper is a highly versatile metal that can conduct electricity and is a necessary trace mineral in all living things. It is less valuable than gold or silver in terms of price. The New York Mercantile Exchange (NYMEX), where copper contracts are a traded commodity, states that copper is the third most widely used metal in the world. It is mined in large open pits and Chile and the U.S. have extensive reserves of copper that could be exhausted within the next 50 years.

Copper Market History

Although copper is a non-precious metal, it is widely used as a commodity to conduct electricity. Most of the world’s electrical and communication infrastructure is dependent on the metal. In the current state of technology, copper is in consistent demand.

Copper Market Facts

- One of the major factors that sets copper apart from all other types of metals is the fact that copper can be used to establish the economic growth of a particular country. Generally, when the state of the copper industry within a specific country is expanding, it can be taken as a good sign that the economy of the same location is expanding as well.

- Demand for copper has routinely grown in recent years, according to statistics sited by the World Bureau of Metal Statistics.

- Copper consumption increased by 8 percent in 2010 throughout Asia, for example. The demand has continued to climb throughout the world in recent years.

- Europe is the second largest copper consumer, after China, and slower business activity has had an immediate effect on demand for the metal.

- Copper is the third most consumed metal in America behind iron and aluminum.

Copper Futures Trading

Copper futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery from the seller a specific quantity of copper (eg. 25 tonnes) at a predetermined price on a future delivery date. Investors can trade Copper futures on the following exchanges:

- The London Metal Exchange (LME). Copper ‘A’ Grade futures prices are quoted in dollars and cents per metric ton and are traded in lot sizes of 25 tonnes (55,116 pounds).

- Commodity Exchange: At the COMEX—a member of the CME Group—a standard copper futures contract represents 25,000 pounds of copper, while the mini-copper futures represents 12,500 pounds of copper. These contracts trade Sunday-Friday between 6:00 p.m. and 5:15 p.m. (CST). This means investors can make a play for approximately 23 hours every day (there is a 45-minute break period between each day).

- Multi-Commodity Exchange: The MCX offers two popular options for copper, both a standard and mini contract. Standard contracts fall during the months of February, April, June, August and November with contracts representing 1 MT. Mini contracts are 250 kilograms of the industrial metal. This exchange is based in India.

You can learn more about Metals futures by downloading our guide, Free Fundamentals of Trading Metals Futures.

Copper Futures Contract Specifications

| Contract Symbol | Contract Unit | Price Quotation |

| GHG | 25,000 lbs | cents per pound |

| Trading Exchange | Trading Hours | Tick Value |

| CME COMEX | 18:00 – 17:00 (NY) | $0.05/lb = $12.50 |

RJO Market Update

Gold Correction-vs-Reversal Debate Tilts Higher

Macro Market Update

Gold Reaffirms Intra-Range Vulnerability; Maybe Worse

Macro Market Update

Gold Reaffirms Bull, But Platinum May be the “Play”

Beware Gold Bulls’ Heebie-Jeebies Above $2,000

Safe-Haven Flight Flips Directional Scripts on Gold, Silver

Copper May Be One Threshold Away from Meltdown

Silver Joins Gold in Intra-Range Collapse

Gold Confirms Major Correction Lower