If you’re a newer trader, a market with little movement in either direction might not sound very promising.

An informed and skilled trader, however, can generate returns in any market — bull, bear or sideways. In fact, if you’re armed with the right information and strategies, a sideways market can offer plenty of trading opportunity.

To help you better understand what’s involved, let’s take a closer look at the basics of sideways markets, along with some tactics you can employ to take advantage of a range-bound trading environment.

What is a Sideways Market?

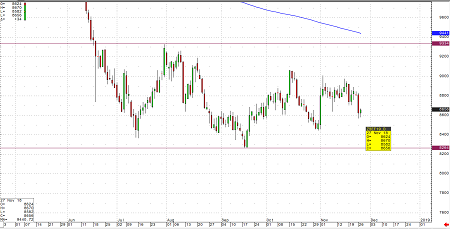

A sideways market can be simply defined as one with no bullish or bearish trends. Prices trade within a horizontal range, with no definitive upward or downward movement.

A sideways market can be simply defined as one with no bullish or bearish trends. Prices trade within a horizontal range, with no definitive upward or downward movement.

To put that more plainly, a sideways market features tight ranges; prices don’t make higher highs or lower lows.

Sideways markets occur with frequency and often indicate that traders have some uncertainty about the direction the market is taking. As a result, many traders exercise caution, consolidating profits during range-bound periods.

How to Identify a Sideways Market?

Identification of support and resistance levels is key to identifying a sideways trading environment. These levels create a range dictating short-term trading behavior. Traders will enter a position once price drops to support level and sell when price rises to resistance levels.

If resistance is broken and a higher high is established, this indicates that sideways action may be ending, and a bull market could follow. Should a lower low be established, this is a sign for traders that a bearish period may be at hand.

Common Sideways Market Indicators

An ADX reading greater than 25 is generally regarded to be an indication that a trend is present. A reading below that figure is generally indicative of a trendless trading environment.

Within range-bound markets, there are also indicators that can be used to identify tops and bottoms with greater precision — an essential aspect of successful sideways trading.

These include STARC and Bollinger Bands and the Commodity Channel Index.

Strategies for Sideways Market Trading

While it’s often said that sideways markets are challenging environments for traders, the truth is not so clear cut. There are tactics and strategies that traders can deploy to exploit opportunities in sideways markets that other traders miss.

Sideways markets also provide traders with a critical benefit: A better idea of when to time entries and exits, thanks to well-established support and resistance levels. Traders can stay within a tight range, accumulating smaller profits on a larger number of trades, while using stop losses to limit downside exposure.

Anticipating breakouts, both above and below the trading range, is one of the most effective of these strategies. This allows traders to take a position within the earliest stages of a new trend.

When prices are set to close above resistance level, a trader will typically assume a bullish position, with the reverse being true for entry points near support levels.

The next step is determining whether a true breakout is occurring. If prices do not move back into the established range by the end of the day — or if volume has significantly spiked — it may be an indicator that a breakout is at hand.

It’s important to note that the longer support and resistance levels have been in place, the greater the validity of the range, in most cases.

Option Strategies for Sideways Markets

Traders follow a number of indicators to determine whether a sideways channel is in effect. The Average Directional Index (ADX) is one such indicator.

Traders follow a number of indicators to determine whether a sideways channel is in effect. The Average Directional Index (ADX) is one such indicator.

Sideways markets can be fertile ground for options traders, and there are a few popular strategies available that maximize opportunities created by the specific conditions present during a sideways channel.

A short strangle is one such sideways option strategy. This involves selling both a put and a call simultaneously on the same security. The seller gets to keep the premium he receives on both options if they expire worthless — a more likely outcome in a sideways market.

Because there is the potential for significant downside with a short strangle, this is a strategy that’s recommended for more experienced traders, though sellers do have the ability to close open positions, forego the premiums and take a limited loss.

Another common strategy is the calendar spread. This involves buying the same type of option (call or put), for the same security at the same strike price — but with different expiration dates. Traders can go long on calendar spreads (buying the asset with the longer expiration date and selling the shorter date) or short (where the reverse is true).

Given that options with less time remaining have a faster rate of decay, the short option loses value faster when going long on a calendar spread. In a sideways market, this provides the trader with an advantage.

The Takeaway

A sideways market shouldn’t deter an options trader, but it should have an impact on the strategies those traders employ.

By learning more about sideways market strategies and the indicators that help identify trends and movements, you can make more informed trading decisions — and trade with confidence in any market.