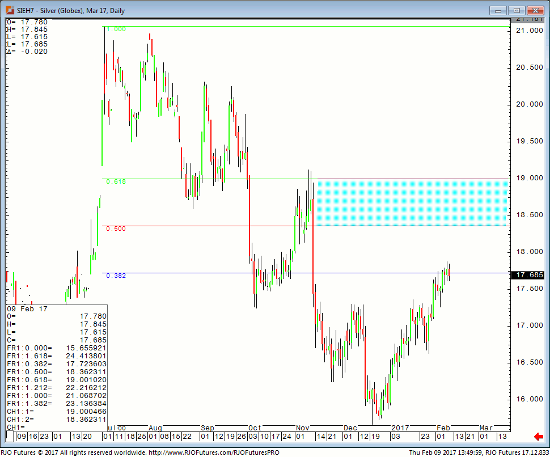

March silver contract is trading $17.60, down 12 cents on the day. The ongoing theme is that the strength in the US dollar has put a tremendous amount of pressure on metal markets in general, and silver is no exception. Since December 2016, silver has been trying to build a base and post a formidable rally off the December $15.60 area lows. The recent weakness of the last 24 hours, in my view, is nothing but a pullback and consolidation price action. What I find interesting is that silver has been generally friendly to equities, but has recently been moving away from that positive correlation, even as the Dow Jones is posting over 20K. While a short term top seems to be forming in the price of March silver futures, the real question remains: where will support come into play?

Traders are continuing to weigh in on the new administration’s policies, and market headlines continue to produce event risks for the silver market. It will be important to also keep an eye on the US Federal Reserve Open Market Committees statements and actions, as US interest rates should directly affect the trends of the precious metal markets. Traders will likely view silver futures as an alternative to the US Dollar, so as interest rates rise and the value of the US dollar increases, I expect that to weigh negatively on the price of silver.

From technical prospective, silver futures should continue to pull back a bit, and I will look forward to review the COT report this Friday to see non-commercial and non-reportable positions. I expect silver futures to continue to post gains towards the full 50% retracement of the prior decline at 18.37. The first objective of this rally has been met into the 38.2% line at 17.74, and this Fibonacci resistance level has offered a short term top in the market. I will be looking for support into first the 17.30 prior highs from January 18th, and below that the 16.70 (50% Fibonacci support from the prior rally). Continued turbulence out of Asia warrants monitoring the geo-political concerns that may arise over South China sea. It’s clear there are plenty of headlining events that could spark volatility in the silver market, and extra attention to global events should be a top priority.