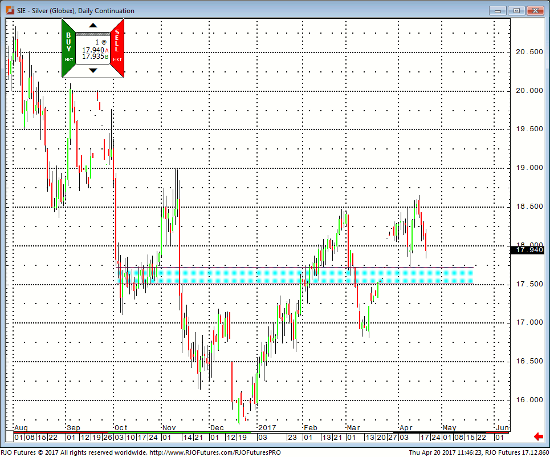

May silver is trading $17.94 down about 21 cents on the day. My previous article discussed the potential for a pull back side ways to lower type of price action from the move above 18.50 range. It appears trading is moving to a support zone, possibly low $17.50 area. As I’ve mentioned in the past, the near-term upside target seem fulfilled provided we continue to hold below $18.50. It’s worth noting, this range type of price action can provide option trading opportunities. For now, unless we get a blowout type of price action i.e. rally above $18.50, trades look to go from sideways to lower type of price action.

On the news, from the geopolitical stand point, Syria is waiting in the background as North Korea comes back into the picture once again. I believe the real audience is China. U.S wants China to get aggressive with North Korea, or else risk potential conflict near its borders. For now, at least, geopolitical concerns are not driving silver.

Again, for now at least, silver is taking a bit of a breather. There is nothing right here right now that calls for being super bearish of silver. Further weakness will probably find bargain hunters.

The technical picture has May silver futures looking sideways to lower price action near term. Low to mid $17.00 range probably will provide some opportunities. Of course, a close above 18.50 will ignite momentum price action.

Silver Daily Chart