With the fundamental picture for coffee production firming as initial concerns of drought in Brazil have subsided, ICE coffee futures have extended their decline and are now testing below the May 2016 lows in the continuous contract. Weather premiums being discounted for the world’s largest coffee producing nation (Brazil at over 35%), have sent coffee futures into free fall into next month’s harvest. While this is seasonally a time of the year for coffee futures to price in the new crop yields, and May often finds a seasonal low in price for the year, the coffee trade is currently flush with good Arabica beans in stockpiles across major consuming nations, and it’s estimated that over three months of consumption is already on hand. While seasonality suggest the 2017/2018 global coffee crop will be an off year for production in Brazil, recent news of improved conditions are forcing the trade to reconsider this stance.

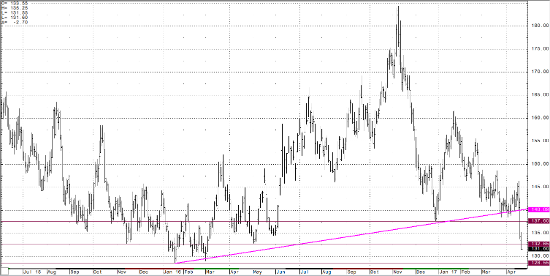

From a technical perspective the daily chart of ICE coffee futures has broken below multi year lows as well as trend line support drawn against January ’16 lows (128.55) to December ’16 lows (137.60). Below these critical levels for coffee futures signals there may be a broader adjustment in Arabica pricing, when you consider where global stocks are currently. The trade can expect to find resistance where broken support once was, into the December 2016 lows (137.60) and April 2016 lows (132.65). The next major support comes in at 128.55, where the market found its lows in January of 2016, and testing these levels will ultimately bring into question if those lows can hold.

In my opinion, the fundamental trade is pricing in the improvement in crop conditions and the technical trade is confirming this trend. Unless there is a weather event that sends the upcoming harvest into a panic, or the global market increases its demand for Arabica (to alleviate the 3 months of consumption stored away) the trade has spoken and is favoring the bears. Breaking below key levels, improving weather conditions, and global stockpiles with coffee on hand is a triple threat that will continue to drive trade until one of these situations changes.

If you have any questions or would like to discuss the markets further, please feel free to contact me at 877-963-6484 or hgalvan@rjofutures.com.

Coffee Daily Continuation Chart