Traders remain skeptical over the possibility of a significant tax cut and the S&P challenged the high and failed yesterday to close slightly lower on the day. Asian stocks posted mixed results overnight as the Shanghai Composite finished the day with a moderate gain. Both the German Gfk consumer survey and a set of Euro zone sentiment readings saw better than expected results. The latest European Central Bank monetary policy meeting is expected to have no change in rates or policy, but a post-meeting press conference by ECB President Draghi may hint at upcoming policy changes. The North American session will start out with a weekly reading in initial jobless claims that are forecast to see a modest down-tick from the previous 243,000 reading. March durable goods are expected to see a moderate down-tick from February’s 1.8% reading. March pending home sales are forecast to see a sizable decline from February’s 5.5% reading.

Global markets may have shaken off early pressure, but sentiment turned lukewarm following events in Washington as market attention focused on events at the White House. When the actual details came out, however, risk sentiment deteriorated and was further rattled by reports that the White House was considering an executive order to withdraw from NAFTA. While the NASDAQ reached another new record high and the S&P and Dow Jones were within striking distance of new high ground, US stocks eventually turned lower as all three major indices finished lower on the day.

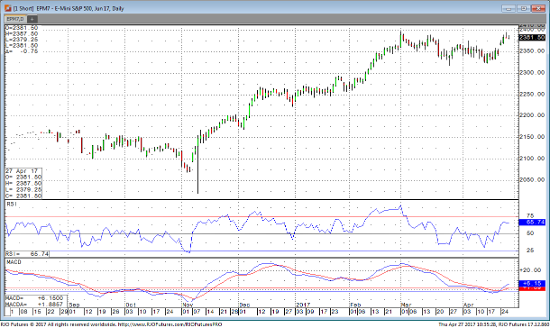

S&P 500: The three-day surge leaves the market overbought and traders see a lack of details on the proposal as a reason to suspect that it will take time for a consensus. Longer-term, a 15% corporate tax rate would be extremely bullish for stocks but short-term, the market may not be ready for another leg up. Uncertainty could spark some light selling pressures short-term unless economic news come in reasonably strong. Breaks are buying opportunities, however we cannot rule out a short-term correction. June E-Mini S&P close-in resistance is at 2389.65 with 2365.75 and maybe 2356.25 as short-term downside targets.

Jun ’17 Emini Daily Chart