With WTI Crude futures trading up $1.00 from its recent low in the July contract, trade is beginning to benefit from eighth straight decline in crude oil inventories, as estimated by the EIA Petroleum status report. The EIA status report, which estimated a 6.4 million barrel draw on inventories, only added to the bull’s argument, which began the night before when the API estimate released an 8.67 million barrel draw for the same period. While these two news items certainly stand to support the rhetoric out of OPEC nations for continued supply cuts, the market will likely need to see some key price levels hold to confirm the fundamental bias with a technical foundation.

OPEC continues to make headlines, reiterating their rhetoric for continued production cuts, and it is safe to assume the recent draws in inventories will help their cause. WTI Crude prices still remain in “no man’s land” hovering above key support but below key resistance, so there is clearly no victory for either bears or bulls for the moment. What will be important to watch for the time being, are the May lows (43.76 from June contract, and 44.13 for July), as well as the May highs (52.00 for July). While inside these levels, expect to see a fight over trend and continued range bound price action.

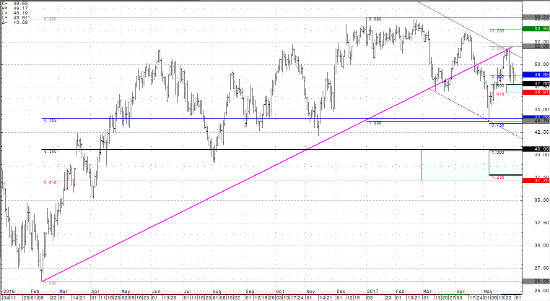

From a technical perspective, July crude futures have traded into their 50% retracement from May lows to May highs. This supportive inflection zone is created by both the 50% to 61.8% as well as the 100% equal legs, that all come between 47.88 and 46.60. This $1.20 range is a supportive price band which while above, could call for a rally to test 53.94. If trade can press below 46.60, I expect a retest of the 43.76 May lows (from June contract), and below there, a move to test the 40.65 inflection zone and 40.00 psychological handle. It will be important to keep some ammo dry in this storm, and ready to fire when the firing solution becomes more apparent. These are choppy and tough markets, but every day is one day closer to a resolution.

Jul ’17 Crude Light Daily Chart