The futures markets job is to alert consumers, producers and traders to the possibility of a problem with the supply side fundamentals. The corn futures market has been under pressure for years now due to more than adequate supplies and waning demand.

I think we can all agree that the single biggest fundamental factor impacting grain prices is weather. Too much rain, not enough rain, too hot, and too cold. All of this affects the production, and therefore the supply.

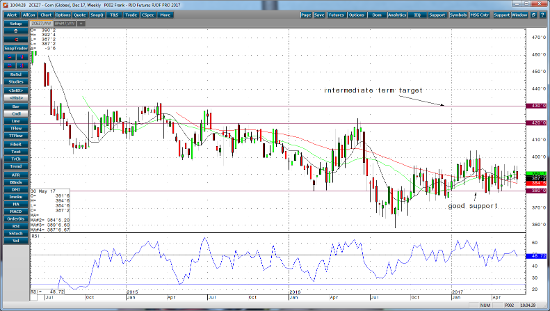

I see a problem coming that will hurt the supply. I want to sound the alarm now that the corn crop is shrinking! Some of you are thinking that it’s too soon to be concerned and that there’s still a lot of time for the crop’s condition to improve. Today is June 1, and corn yields are already being negatively affected due to poor seedings throughout southern Illinois and southern Indiana. There’s a good possibility that the USDA will lower corn acreage as a result of the excessive rain from April through May. It’s too late to plant corn. As time goes on we may see an uptick in the crop’s condition, or we may not. There is a very large net short position by speculators, and if December corn gets a pop above the $4.00, you won’t want to get in the way of a short covering rally that will be triggered by the below average yields on top of lost acres. I can see new crop corn prices targeting the $4.20 to $4.30 range.

Dec ’17 Corn Weekly Chart