From a fundamental standpoint, the bear camp will suggest the crude oil market was under noted pressure at the ends of last week because of fears that slack growth in the US could dent energy demand in the months ahead. In fact given softer than expected US auto sales last week, disappointing US payroll results last Friday and the possibility of a risk off psychology due to terrorist activities over the recent weekend, the energy demand equation as a whole favors the bear camp to start the new trading week. As if the negative demand track is not enough to pressure prices, the fact that the oil producer’s production cut plan has now been put in the rear view mirror could leave compliance as the next focal point of the energy trade. Adding into the bearish supply side case is the news that US horizontal drilling rigs rose by five in the week ending June 2nd and that is the 20th straight weekly rise in a row. On the other hand, the bull camp will suggest that the market rejected large portion of the Friday declines as if prices below $47.00 were too cheap. It is also possible that Middle Eastern tensions will be fanned by the severing of diplomatic and economic ties between Qatar and four other Arab countries. Overall, the energy markets have lost respect for the production restraint and some might argue that OPEC will now have to do even more to support prices. In a caution to the bear camp, there has been a pattern of declining crude oil inventories in the US, US gasoline demand is already at record levels, US refiners are ramping up production to meet surging demand, and that can result in surprise outages. Furthermore, the Commitments of Traders Futures and Options report as of May 30th for Crude Oil showed Non-Commercial and Non-reportable combined traders held a net long position of only 411,586 contracts and clearly, that positioning is overstated given the slide following the report of $3.00 per barrel! The market might not be fully liquidated but the risk of further sharp declines has shrunk.

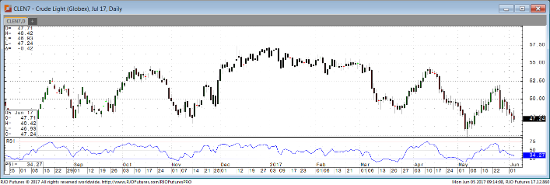

Jul ’17 Crude Light Daily Chart