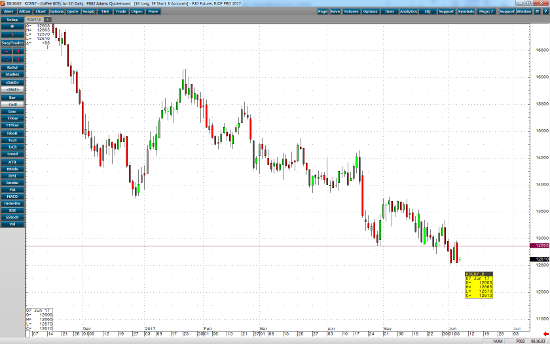

As July coffee nears the end of its life, we can see a drastic violation of the 12868 critical support area we mentioned in our last article. Most of this weak price action in coffee can be contributed to sluggish demand, and the Brazilian harvest, currently underway, is looking to replenish any tight supply issues that may currently be in place. Outside market forces include the UK election taking place on Thursday of this week, coupled with the testimony of former FBI director, James Comey. These are fundamental forces that may shake things up and affect the coffee market quite a bit. For now, we will wait and watch.

On the daily chart of July coffee below, we mentioned the violation of the 12868 critical low from April 17th, which shortly after, was followed up by some sideways consolidation. We now see coffee prices in a well-defined range, which will likely be a good opportunity for swing traders. We haven’t seen prices in this area since March of 2016. The 12450 area will now become the key support level to monitor because a violation of this area will likely result in a continuation of the downtrend.

Jul ’17 Coffee Daily Chart