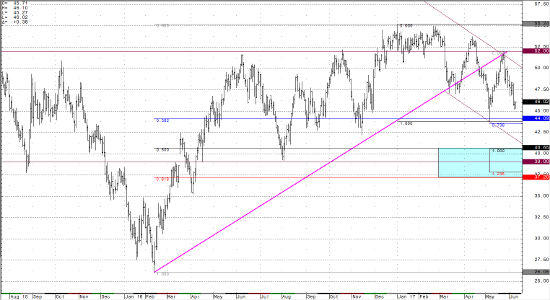

With WTI Crude futures trading down $6.00 from its 52.00 handle highs two weeks ago, the market is continuing to whip through the middle of its range, only finding resistance above 52.00 and support below 44.00. As long as this range stays intact, in my opinion, it’s a clear indication the geo-political and economic struggle between OPEC and Western oil producer is still underway. The West, which continues to suppress the price of oil by increasing production of North American shale and ethanol, while OPEC and friends attempts to cut supplies and offset the western increase.

OPEC continues to make headlines, reiterating their rhetoric for continued production cuts, however, and their attempts to support this market with talk is proving too cheap. It’s almost impossible to compete with the supply American and its western oil allies are able to ramp up, with the ability to extract shale as well as convert agricultural gains to energy products (ethanol and biodiesel). WTI Crude prices still remain in “no man’s land” hovering above key support but below key resistance, so there is clearly no victory for either bears or bulls for the moment. What will be important to watch for the time being, are the May lows (43.76 from June contract, and 44.13 for July), as well as the May highs (52.00 for July). While inside these levels, expect to see a fight over trend and continued range bound price action.

From a technical perspective, July crude futures have broken below the 50% retracement from May lows to May highs, which I mentioned as a level to watch in last week’s article. Since the trade has now pressed below 46.60, I expect a retest of the 43.76 May lows (from June contract), and below there, a move to test the 40.65 inflection zone, it’s very likely to test the 44.13 lows and possibly even the 40.00 psychological handle. Every day crude spends in this range, should result in additional stops above and below the range highs and lows respectively. The stops clustered at those levels should eventually then be the fuel for a burn above or below those thresholds, but while the range remains intact, it’s a range until it fails.

Crude Light Daily Chart