Global equity markets were mostly mixed this week. All things considered the ability to claw up and away from last week’s lows and shake off the sudden turn in sentiment against the high tech/high priced Bellwether issues is impressive. It would appear as if the market is poised to draw in fresh bargain hunting buying off the idea that US rates will remain low for an extended period of time and that growth will remain positive even if growth rates are expected to be less than stellar. In general, geopolitical anxiety is running much lower than last week and that might also be encouraging investors to pick up FANG stocks at a discount to their recent highs. In general, the September E mini S&P remains mired within an eight day trading range with close-in pivot point support today seen at 2421.75 and resistance seen up at 243700. The index seems to have garnered some spillover lift from generally positive international equity market action overnight and also from a favorable NFIB survey of small business optimism. Uptrend channel support off the May and June lows is seen at 2421 and support level rises to 2426 this week.

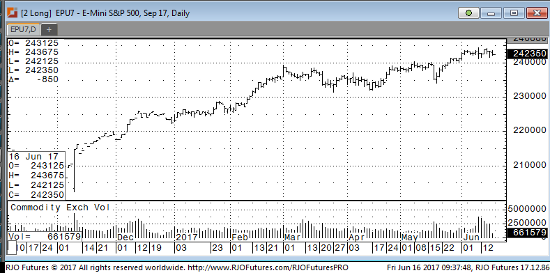

Sep ’17 Emini S&P Daily Chart