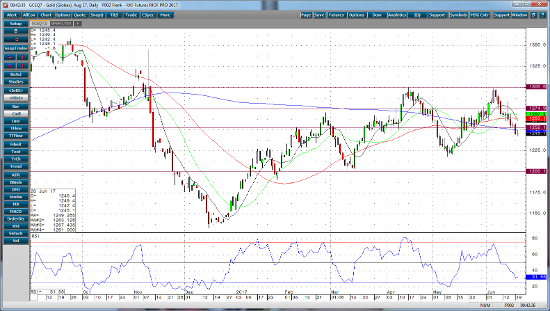

Now that the $1,250 support level in gold futures has been taken out, it seems likely that the market will soon test the support around the $1,225 to $1,220 trading range. Below that level we really don’t see any meaningful support until the $1,200 level, which we haven’t seen since mid-March.

Perhaps the most bearish argument for gold right now is that the Fed is more “hawkish” than what we have grown used to. When looking at gold futures, we must also consider the US Dollar gaining strength. The dollar has been basing a solid bottom for the past four weeks.

Now, we have a market here that has a large consolidative trading range, call it $1,200 to $1,300. So far this year that has pretty much been the low and high with not a lot of time spent sitting in between those lows and highs. The $1,250 to $1,275 range is where the market tries to take a breather, both on the way up and on the way down. However, on this current sell-off the market didn’t really pause along the way from $1,300 to its current price today at $1,245. There is some small support at $1,240 and then $1,225 after that. The market is approaching over-sold levels but down is still the path of least resistance. Additional factors adding to gold weakness is a lack of safe-haven buying and general weakness in commodities across the board.

So barring any unforeseen event that would drive interest in the “safety trade” I don’t see any reason to try bottom picking until the market tests the $1,200 range. It might be $1,203 or $1,207, but that is where there value range lies.

Aug ’17 Gold Daily Chart