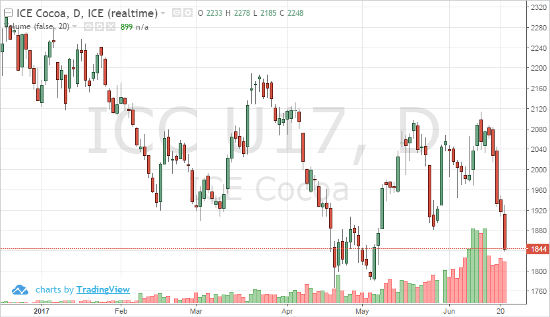

European and North American demand continues to be monotone. Supply levels remain bearish, and weather has not had an effect on production – will El Nino change that? Cocoa’s story line this year is on repeat. Will demand give prices a boost? Will there be a large surplus in production? These thoughts and lack of fundamental news have forced the September contract down below 1850; heading towards year-lows put in back in May. Earlier this year, financial issues in key growing regions were affecting price levels, and new talks have reopened, possibly creating future volatility. If 1825 is tested, 1800 is in sight – buyers may be then tempted to re-establish positions. After five sessions of lower trading, COT data on June 23 may give us a better idea of what traders are thinking. Traders could look at buying calls in the December contract to gain exposure to the market if a recovery is building.

Sep ’17 Cocoa Daily Chart