Clear and steady violations of critical lows (which should have been strong support) seem to continue as September coffee prices paint a very bleak story. As the stock market is on the rise, we can see the price action of the September S&P 500 shows quite the negative correlation to that of September coffee prices. Many traders might make logical sense of the fact that a strong stock market should equate to stronger demand, but we must keep in mind that coffee prices will need to see some significant depletion of our existing abundance of coffee stocks in order to lift prices higher. Not likely in the near future.

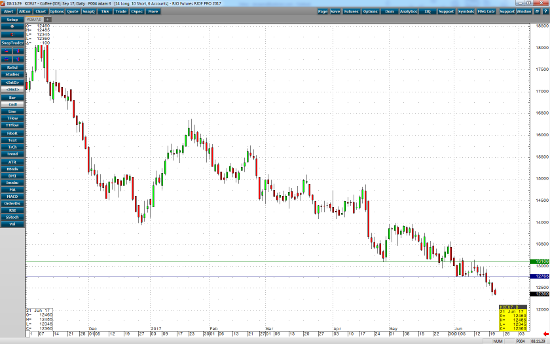

On the daily chart of September coffee below, we can see the aforementioned violations of the 13106 and 12765 critical lows. Both of these levels should have posed some support, but coffee prices have destroyed these levels with some volatility. Until we see some very big supply numbers dwindle, traders who believe that “the trend is your friend” should continue to be bearish.

Sep ’17 Coffee Daily Chart