Just after the open, the S&P is still stuck in the middle of the last few days’ range. We’re seeing a pattern of higher lows and lower highs at a level we’ve been trading at for the majority of the month. Looking back, the pattern we’re seeing reminds me of what we saw beginning around the last week of January and into the first week of February. The second half of December was a range bound trade, with a strong, short-lived selloff around the new year. The majority of January was also range bound right around the same level that we saw in the second half of December. The market then attempted to break out to the upside, but quickly gave up all those gains and returning to levels near the previous range. Then next few days of trading were spent reestablishing a range with a slightly higher low. Then the market proceeded to go on an absolute tear, as you’ll see in the chart below.

Sep ’17 Emini S&P Daily Chart

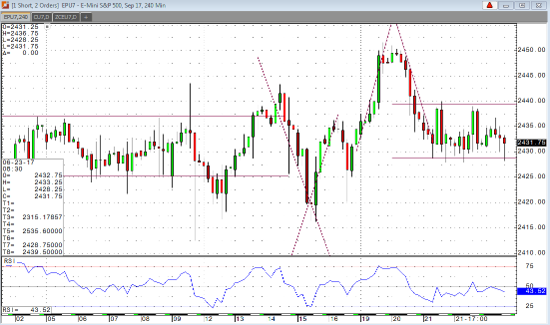

Breaking down the recent pattern on a shorter time frame, you’ll notice some similarities. A range bound trade is followed by a big selloff. The selloff is quickly forgotten, and the market attempts to breakout to the upside, which fails. The market then establishes a new range, slightly above the previous one. We’ll see where we go from here.

Sep ’17 Emini S&P 240 min Chart

To expect another move of that magnitude would probably be a bit optimistic as the S&P is approximately +170 from where it broke out in February, but stranger things have happened. I would also take into account the fact that the pattern the two charts vary greatly in time frame as one pattern shows what developed over a period about twice as long as the other. That said, I think there may be some significance to the similarities. Keep an eye on the energy markets as well. I think if we can get a bit of a lift in that sector, it will open the door for the next leg up in the market.