Dollar: With fresh damage in the dollar chart this morning and generally upbeat action in all actively traded non-dollar currencies it would appear as if the bias in the dollar has returned to the downside. We suspect today’s second and third tier scheduled US data will provide only a temporary and very limited support to the dollar and that a slide below 97.00 is due and a possible low for the day today is seen down at 96.82. For the dollar to throw off a three day pattern of weakness probably requires something surprisingly positive from the Washington news cycle.

Sep ’17 Dollar Index Daily Chart

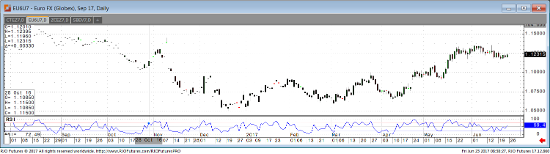

Euro: While part of the strength in the euro early today is the offshoot of unfolding dollar weakness we also get the sense that the political and economic environment in Europe continues to improve. In fact, the grains in the euro this morning are impressive when one considers that German June manufacturing PMI readings came in below the prior month. In fact, German June services PMI readings came in significantly weaker than the May readings and yet the euro is showing no ill effects of the data flow. In short, the pattern of higher lows and higher highs has extended and that could leave little in the way of resistance in the September euro until the 1.1298 level. Support in the euro this morning moves higher to the 1.1203 level.

Sep ’17 Euro Daily Chart