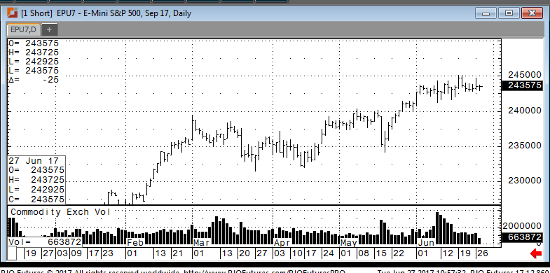

Global equity markets were mixed overnight with Asian markets generally higher and the rest of the world under minor pressure. We are a little surprised that US markets aren’t showing more favorable early action in the wake of the positive leadership from Asian stocks, upbeat ECB economic views, and strong Italian consumer confidence results. However, news that google was presented with a 2.4 billion antitrust fine from the EU, and the prospect of intense political fighting in Washington over the healthcare reform bill has probably put US investors and traders on a back foot to start today. We are little disconcerted with the charts in the S&P, as an extending sideways consolidation hints at a loss of upside momentum and a potential critical decision point ahead. As indicated already, the sideways action in the E-Mini S&P suggests that investors are losing their interest in buying breaks and that has also resulted in a quasi-triple low zone at 2428-2428.25. Therefore, the market appears to have a critical pivot point just below the current market and a sweep of disappointing US scheduled data today could see prices slide in a valuation driven break.

Sep ’17 Emini S&P 500 Daily Chart