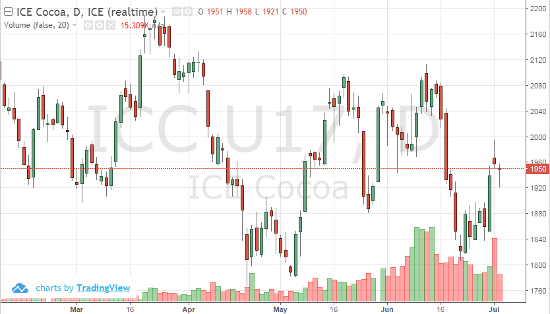

September cocoa is trying to break and hold above 1950 – but hasn’t had any luck. With the US holiday mid-week, traders are trying to position themselves for the longer-term trade while keeping the lower volume and abbreviated schedules in mind. A large net spec short position in cocoa helped the market rebound. Higher Ivory Coast production has already been priced in the market so any “new” news is what the market play off of now. London weakness and a stronger dollar along with lower energy prices have pressured cocoa. The arrival data is playing a part in cocoa’s current state – numbers are in-line with last year’s data that was affected by El Nino. Heavy rain in San Pedro has affected paths to ports which has also helped move the market. This rain has damaged bridges and could affect exporting but the rain will be beneficial for the 17/18 new crop. With resistance at 1960 and 1995 we will need more demand news to break above 2000. Look for volatility and choppier trading over the next week.

Sep ’17 Cocoa Daily Chart