We’ve seen some good strength in September coffee prices over the last few trading sessions, but the fundamentals are still quite uncertain. Mixed import and export numbers seem to have September coffee prices in a perpetual range-bound swing. Over the past month, we witnessed convincing violations of critical lows of September coffee prices, which should have been strong support. Continuing strength in the US stock market, had seen some negative correlation to that of September coffee prices. As we mentioned in our last article, traders need to see some significant depletion of our existing abundance of coffee stocks in order to lift prices higher. Lately, larger producers in Brazil and Costa Rica are witnessing lighter exports, not likely to hold this intermediate uptrend in place.

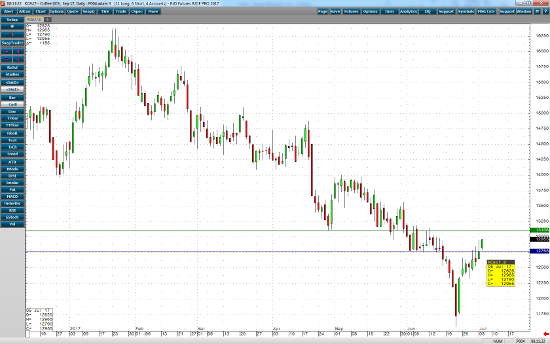

On the daily chart of September coffee below, we can see that September coffee prices were able to garner enough support to break above the 12765 resistance level, which prompted a quick run up to the 12975. However, bulls should be cautious around the 131 level, as this should be solid resistance. Until we see some very big supply numbers dwindle, traders who believe that “the trend is your friend” should continue to be bearish. This could be a decent time for a selling opportunity.

Sep ’17 Coffee Daily Chart