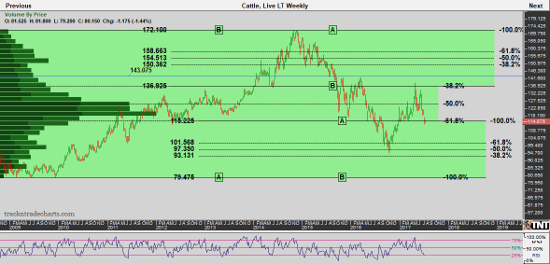

Higher feed costs, larger placements and marketings, historically high net fund longs, lower seasonal demand and “huge” beef production contributed to lower cattle futures prices over the last 30 days. As corrections often do, the charts retested the base of the initial rally back in late April in the 112-115 area in front-month fed cattle futures. As a consequence, RJO Market Insights’ Dave Toth pegged this area as a point on the charts that needs to hold to resurrect a downtrend that he mentioned maybe major in scope. To the upside, 127.65 is an area to watch on a long-term scale needed to break “to negate the major peak/reversal count.”

My value range in fed cattle (106-118 to 125-127) is still intact and I see little fundamentally for this LT value area to be breached anytime soon. There are several gaps to fill in front month fed cattle futures (119, 124.50 then 127.10). The shakout areas are 125 then 128.50 in LCQ7. In feeder cattle the sub 140 area and 135 areas are key supportive areas that maybe good lines in the sand for those looking to hedge a break below. To the upside, 152.70-153 then 161 areas in August FC are good areas of resistance and potential hedge points to consider triggering an entry.

The beef market is still long term bearish on the charts and possibly in the beginning of a corrective rally with many levels of gaps and value areas to retest. A sustained move higher beginning with today’s limit rally will only add to the funds historically high net long, provide incentive for feedlots and packers to move product and buyers to buy product. Hot weather will only contribute to this trend of increased production.

Hightower research noted today in their Daily Cattle Commentary…“Beef product in the third quarter is expected to reach a seven year high for that time of year. It is also expected to increase 415 million pounds from the second quarter, which is a record increase for that timeframe.”

There is obvious underlying demand in the beef market supporting this surge in production/supply. Exports were up 3.8% in May. This is a good market for hedgers on both sides of the trade. Have a plan and keep an eye on 108 in live cattle futures and 135 in feeder cattle futures as key underlying support.

Live Cattle – Weekly Chart

Source TrackN’Trade