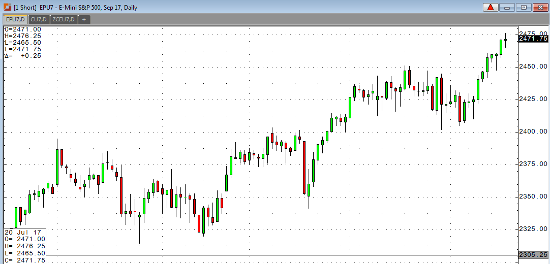

The grind higher continues today as the September mini S&P printed yet another new all-time high at 2476.25 earlier Thursday morning. While we have backed off the highs slightly, a green close would mark the tenth day in a row that the mini S&P has managed to settle higher on the day. We’ve had some favorable earnings results to provide a bit of a boost, but I’m somewhat surprised that the market has been able to stay afloat as well as it has given the lack of anything meaningful coming out of Washington. The healthcare reform bill was shot down yet again, and it also doesn’t appear we’re all that much closer to tax cuts. Both of these have been cited as potential catalysts for the next move higher, but I’ll believe it if and when I see it. With a light news schedule tomorrow, I believe traders will continue to monitor earnings results, any progress out of the political arena, and next week’s data for direction. Tuesday kicks off another FOMC meeting and GDP will be released on Friday, July 28.

Sep ’17 Emini S&P 500 Daily Chart