In the recent weeks we have seen the September silver contract posted a major low of 15.145 on July 10. Much of this could be attributed to the consistently positive US economic data, the generally hawkish tone in the Fed leading to a strong dollar, and really a lack of any real geopolitical concern around the world. At this point, the Fed is unwinding the balance sheet which could be a trigger that pressures the metals complex as a whole. The question is, was this news already priced in? We are still pricing in another rate hike before the year end which should, in theory, pressure silver. The biggest bull news for metals is most assuredly the US dollar being at 10-month lows, and all three US stock indices are making record highs seemingly every week. A risk-on psychology is coming back into the market. All other things equal, a weaker US dollar lifts commodities across the board as it makes our commodities more competitively priced around the world, including the silver market and metals in general, which are seen as safe haven assets. A weaker US dollar becomes less attractive from an investment standpoint when metals remain strong. Silver has the potential to make another run back to the technically and psychologically important $17 level within the next few weeks.

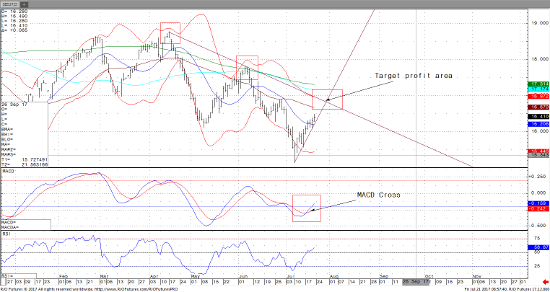

A strong bull picture in September silver lies in the technicals. A clear downtrend has been broken, the MACD has crossed indicating a buy, and we are clearly walking up the trend toward the $17 level. If we do happen to pullback, $16 is a new area of key support, while 16.85 is going to be resistance. We are currently trading at 16.42 this morning, and show no signs of stopping this march toward $17.

Sep ’17 Silver Daily Chart