Global equity markets were mixed overnight with Asian markets weaker and European markets higher. Clearly, positive action in European stock markets was lost on the early US trade, perhaps because DuPont disappointed the market with a 15% decline in second quarter profits and the trade was somewhat disappointed with the results from Alphabet yesterday. However, the market appears to have shaken off the drag from fears that Google costs-per-click will continue to rise, and it also appears as if the markets have discounted the large EU fine lodged on the massive internet giant. All things considered, even a slightly positive track in equities early today points to ongoing bullish resolve, but the trend for the day might be set early because of earnings. In fact, there will be a busy day of earnings announcements today which will include #M, McDonald’s, United Technologies, Eli Lilly, DuPont, Caterpillar, Biogen, General Motors, and Kimberly-Clark before the Wall Street opening. As suggested already, the E-mini S&P has seemingly shaken off the weaker track put in place since last week’s high with prices potentially approaching the old all-time high up at 2476 sometime later this morning. Initial resistance is seen at 2475 and initial support is seen at 2465. With a very long series of key cyclical before the official Wall Street opening. We have to leave the edge with the bull camp unless something unforeseen from the geopolitical landscape surfaces.

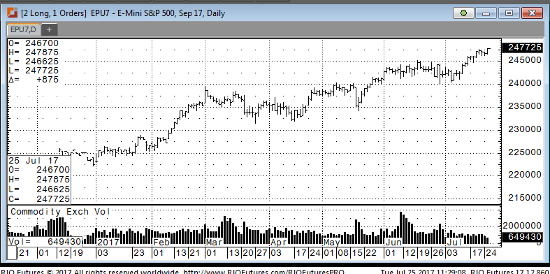

Sep ’17 Emini S&P Daily Chart