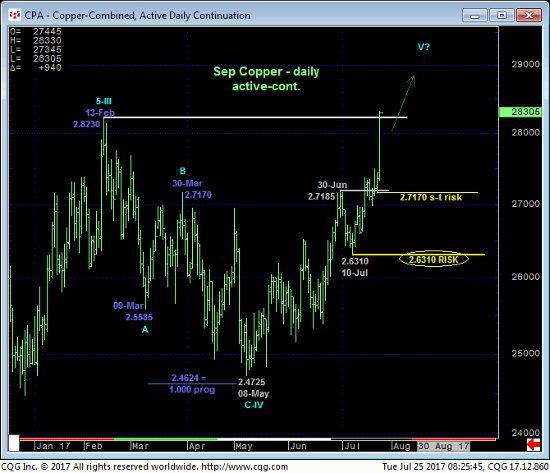

Today’s explosive, accelerated continuation of the past 2-1/2-months’ uptrend and break of this year’s 13-Feb high at 2.8230 confirms our long-term bullish count introduced in 19-May’s Technical Blog. As a direct result of this latest spate of strength the 240-min chart below shows that the market has identified yesterday’s 2.7170 low as the latest smaller-degree corrective low it is now minimally required to fail below to even defer, let alone threaten a bullish count. In fact, the trend is up on all scales and is expected to continue and perhaps accelerate. Setback attempts are advised to first be approached as corrective buying opportunities.

By breaking this year’s 13-Feb high and reinstating an 18-MONTH uptrend, the market has exposed an area that is totally devoid of any technical levels of merit. In effect there is no resistance. Virtually all levels of any technical merit currently exist only below the market in the form of former resistance-turned-support like late-Jun’s 2.7185-area and prior corrective lows like yesterday’s 2.7170 low (tight) and 10-Jul’s 2.6310 larger-degree corrective low and key risk parameter.

Merely derived levels like Bollinger Bands, channel lines, the ever-useless moving averages and even the vaunted Fibonacci relationships we cite often NEVER have proven to be reliable reasons to buck a trend without an accompany momentum failure, and they never will.

Finally, on a long-term monthly log scale chart below, today’s break above Feb’s 2.8230 high reinstates and reaffirms the major reversal of the secular bear market from Feb’11’s 4.65 high. It is indeterminable at this juncture whether the current 18-month uptrend is a major BEAR market correction OR a reversal of the 5-YEAR bear market. In either case however and until the market breaks the current uptrend with a failure below 2.6310, the market’s upside potential is considered indeterminable and potentially extensive (i.e. quarters or even years).

In sum, a full and aggressive bullish policy and exposure remain advised with a failure below at least 2.7170 required to defer or threaten this call enough to warrant paring or neutralizing longs. In lieu of such sub-2.7170 weakness further and possibly accelerated gains should not surprise.