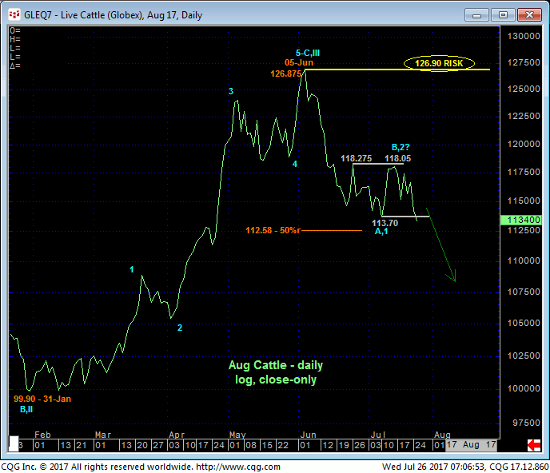

While Mon’s gap-down open and still-intact 112.425 lower boundary to this month’s range leaves the door open for further lateral consolidation that could include another intra-range rebound, yesterday’s relapse below 11-Jul’s 113.40 low and our short-term risk parameter renders the early-Jul recovery attempt a 3-wave affair as labeled in the hourly chart below. Left unaltered by a recovery above 14-Jul’s 118.675 high, this 3-wave rebound is considered a corrective, consolidated affair consistent with our broader bearish count calling for a major correction or reversal of Oct’16 – Jun’17’s major advance. In this regard we are considering 118.70 as our new short-term risk parameter this market is now required to recoup to threaten this broader bearish count and expose a steeper correction of Jun-Jul’s decline or possibly a resumption of 2016-17’s major uptrend.

Given the extent and impulsive nature of Jun-Jul’s 127.65 – 112.425 decline, it’s not hard to envision this month’s lateral chop as a mere corrective, consolidative structure that warns of a resumption of Jun’s downtrend that preceded it. In fact, yesterday’s close below 10-Jul’s 113.70 low close arguably reinstates the nearly-2-month downtrend that may just be the start of a more protracted move south.

The daily log scale chart above shows that, thus far at least, the market has found support are the (112.65) 50% retrace of Feb-Jun’s portion of the bull from 99.40 to 127.65. This week’s relapse however puts that support in jeopardy with a recovery above 118.70 required to resurrect a broader base/reversal count.

Contributing mightily to our bearish outlook is the stubbornly frothy bullish sentiment accorded this market. At a 94% reading reflecting a whopping 121K Managed Money long positions reportable to the CFTC versus only 7.5K shorts, fuel for downside vulnerability remains in ample supply. If you are bullish cattle, you have a LOT of company and competition to get through the same closing window when the overall market forces the capitulation of this exposure. The odds of such forced capitulation will likely increase on a clear break below 06-Jul’s 112.425 low.

Such gross bullish sentiment is fine and does not t pose a threat to a bull as long as the uptrend remains intact. Once that trend is threatened or broken however, like this one was in mid-Jun as discussed in 12-Jun’s Technical Blog, this over-weighted exposure becomes a source of fuel for downside vulnerability that ultimately could turn into a rout.

Jun-Jul’s 12% sell-off has apparently had little impact on all those Managed Money bulls thus far. Until or unless this market diffuses some of this technical weakness with a recovery above at least 118.70 however, and especially if the market breaks 06-Jul’s 112.425 low, this stubbornly frothy sentiment remains intact as a bearish factor that could result in huge, even relentless losses in the period ahead. Per such, a bearish policy remains advised for longer-term players with a recovery above 118.70 required to pare this position to more conservative levels. Shorter-term traders whipsawed out of bearish exposure with 12-Jul’s bullish divergence in short-term momentum are advised to re-establish bearish exposure either on a rebound to the 116.70-area OB and/or on the immediate break below 112.425 with a recovery above 118.70 required to negate this call and warrant its cover.