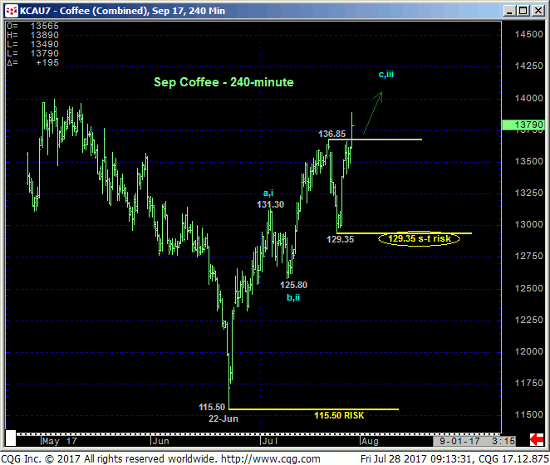

Today’s break above last Fri’s 136.85 high reaffirms our major base/reversal count introduced in 06-Jul’s Trading Strategies Blog and leaves Tue’s 129.35 low in its wake as the latest smaller-degree corrective low the market now needs to sustain gains above to maintain a more immediate bullish count. In this regard 129.35 is considered our new short-term risk parameter from which a still-advised bullish policy and exposure can be objectively rebased and managed by shorter-term traders with tighter risk profiles.

The developing potential for a bearish divergence in momentum is clear in the daily log scale chart below, but only proof of weakness below our 129.35 risk parameter will CONFIRM the divergence to the point on non-bullish action. Until or unless such weakness is proven, there is no way to know this market isn’t primed to take off on a 3rd-wave tangent that could produce steep gains straight away.

In addition to early-Jul’s bullish divergence in momentum, our broader base/reversal-threat count is also predicated on:

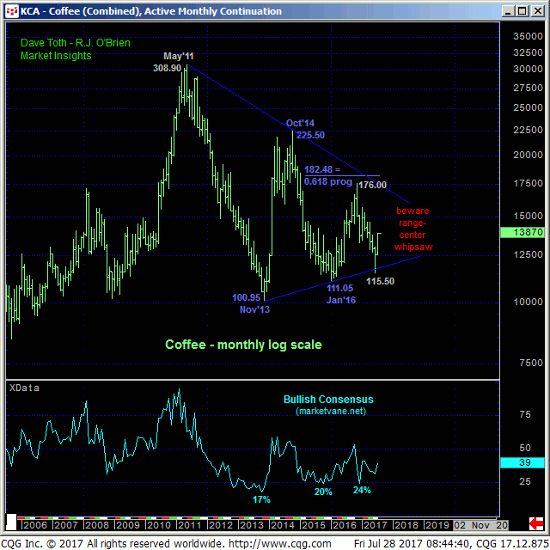

- historically bearish levels recently in our RJO Bullish Sentiment Index of the hot Managed Money positions reportable to the CFTC

- the market’s gross failure to sustain Apr-Jun’s break below Dec’16’s 132.85 low

- the prospective 3-wave and thus corrective decline from Nov’16’s 176.00 high labeled in the weekly log active-continuation chart above

-

- in which the suspected C-Wave down from Jan’s 156.95 high is virtually of equal length (i.e. 1.000 progression) to Nov-Dec’s initial break, and

- the market’s rejection of the lower boundary to an arguable 6-year lateral triangle pattern shown in the monthly log chart below.

These issues considered, a bullish policy and exposure remain advised with a failure below 129.35 and/or 115.50 required to threaten or negate this call depending on one’s personal risk profile. In lieu of weakness below at least 129.35, further and possibly accelerated gains are anticipated straight away.