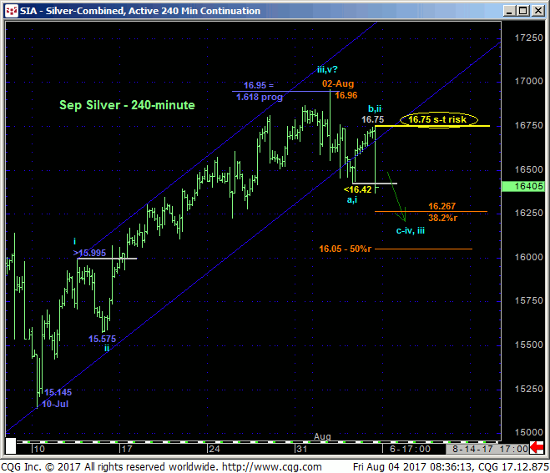

The market’s failure this morning below yesterday’s 16.42 initial counter-trend low confirms a bearish divergence in momentum and exposes at least an interim correction of the rally from 10-Jul’s 15.145 low. As a direct result of this morning’s resumed slide the market has identified today’s 16.75 high as the latest smaller-degree corrective high and new short-term risk parameter it needs to sustain losses below to maintain a more immediate bearish count. Its failure to do so would render the sell-off attempt from 02-Aug’s 16.96 high the 3-wave and thus corrective affair we subjectively suspect it is ahead of a resumption of the past month’s uptrend.

The Fibonacci fact that this short-term mo failure stems from the (16.90-area) 50% retracement of Apr-Jul’s 18.655 – 15.145 decline on a daily log scale basis above would seem to contribute to at least an interim peak/reversal-threat call. On the heels of the extent and impulsiveness of Jul’s rally however as well as still depressed levels in our RJO Bullish Sentiment Index of Managed Money positions reportable to the CFTC, a major base/reversal-threat environment remains intact until the market breaks 10-Juls obviously key 15.145 low and long-term risk parameter. While the market remains below at least 16.75 however, price levels between spot and Jul’s 15.145 low are in play with respect to an “interim” correction.

These issues considered, shorter-term traders are advised to move to a neutral-to-cautiously-bearish stance from at-the-market (16.35) OB ahead of a correction of indeterminable scope. Long-term players are advised to pare bullish exposure to more conservative levels and to the point that they can weather a major failure below 15.145 to negate a bullish count altogether. Strength above 16.75 is required to not only negate this update but also resurrect a broader bullish count that could expose steep gains above 16.96.