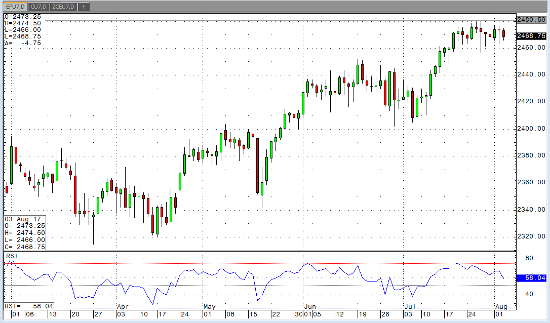

A week and a day removed from new all-time highs in the Nasdaq and S&P, and only two days after new highs in the Dow, the markets are up slightly so far, but a pretty good deal off of the overnight lows. Today’s Nonfarm Payrolls were expected to come in at or around 178,000, down from last month’s surprise 222,000 reading. The actual number came out at 209,000. We were also expecting to see a consensus unemployment rate at 4.3%, down from last month’s 4.4%. That number came in as expected. Markets seem to be looking for a catalyst for the next leg higher. While it would seem as though some positive developments out of Washington regarding healthcare or tax reform would provide the fuel for such a move, it seems rather unlikely that the two sides will be able to come to an agreeable terms any time soon. Therefore, many will continue to monitor data and look for some clues from the Fed mid-month. Next week’s news cycle is fairly light, so traders are looking forward to August 16 when the Fed will release the minutes from the previous meeting.

Sep ’17 Emini S&P 120 min Chart