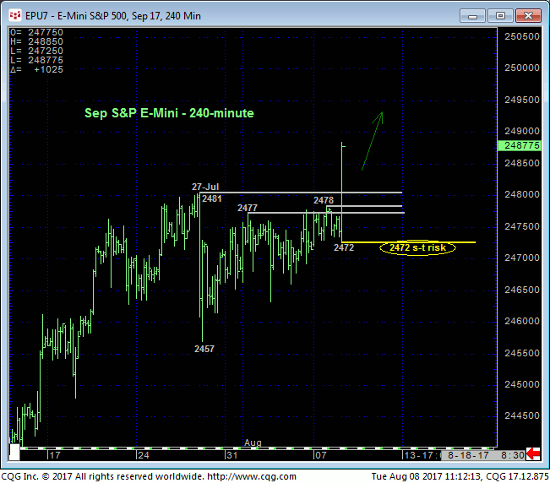

Today’s spike above the past couple weeks’ resistance ranging from 27-Jul’s 2481 high to 2477 nullifies the bearish divergence in short-term momentum discussed in 27-Jul’s Technical Blog, renders the merely lateral sell-off attempt another correction and reinstates the secular bull trend. This resumed strength leaves today’s 2472 low in its wake as the latest smaller-degree corrective low and new short-term risk parameter the market is now minimally required to fail below to even defer, let alone threaten a resumed bullish count. Now-former 2481-to-2477-area resistance is considered new support ahead of further and possibly accelerate gains.

Busting out to yet another new all-time high the trend is up on all scales. In effect, there is no resistance. The only levels that exist above the market are derived levels that have never proven reliable as resistance or support levels without an accompanying bearish (in this case) divergence in momentum. And such a mo failure requires proof of weakness below a prior corrective low like 2472.

On a scale sufficient to threaten the secular bull, commensurately larger-degree weakness below 29-Jun’s 2402 larger-degree corrective low and key risk parameter remains required for long-term players to take defensive steps.

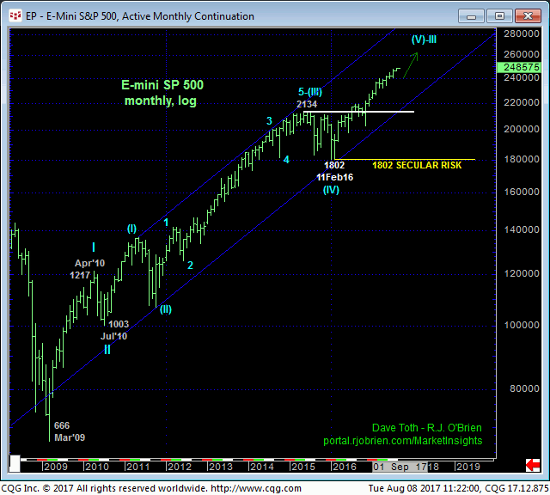

The monthly log scale chart below shows the magnitude of the secular bull market that has remained as unflinching as any and remains one that should not be underestimated until and unless it satisfies our three reversal requirements on ever a daily scale, let alone a weekly one required to truly threaten the bull.

In sum, a full and aggressive bullish policy remains advised for long-term players with a failure below 2472 required to pare bullish exposure to a more conservative level and subsequent weakness below 2402 to jettison the position altogether. Shorter-term traders with tighter risk profiles whipsawed out of bullish exposure following 27-Jul’s mo failure below 2462 are advised to re-establish a bullish policy at 2482 OB with a failure below 2472 required to negate this call and warrant its cover. The market’s upside potential is indeterminable and potentially extreme and should not be underestimated with former 2481-to-2477-range resistance considered new near-term support.