September coffee prices are seeing some good, long liquidation, to the point of an intermediate trend violation. Failure to hold support at the 140 level has left coffee prices spiraling downward to the 130 level, and in a hurry. A healthy outlook in Brazilian production numbers for next season seems to be the reason. These bearishly-revised production numbers, along with a strong US Dollar seem to be the fundamental forces that are keeping prices under pressure. In addition, it looks like more rain is on the way for the Arabica growing areas, which will also add to the bearish side.

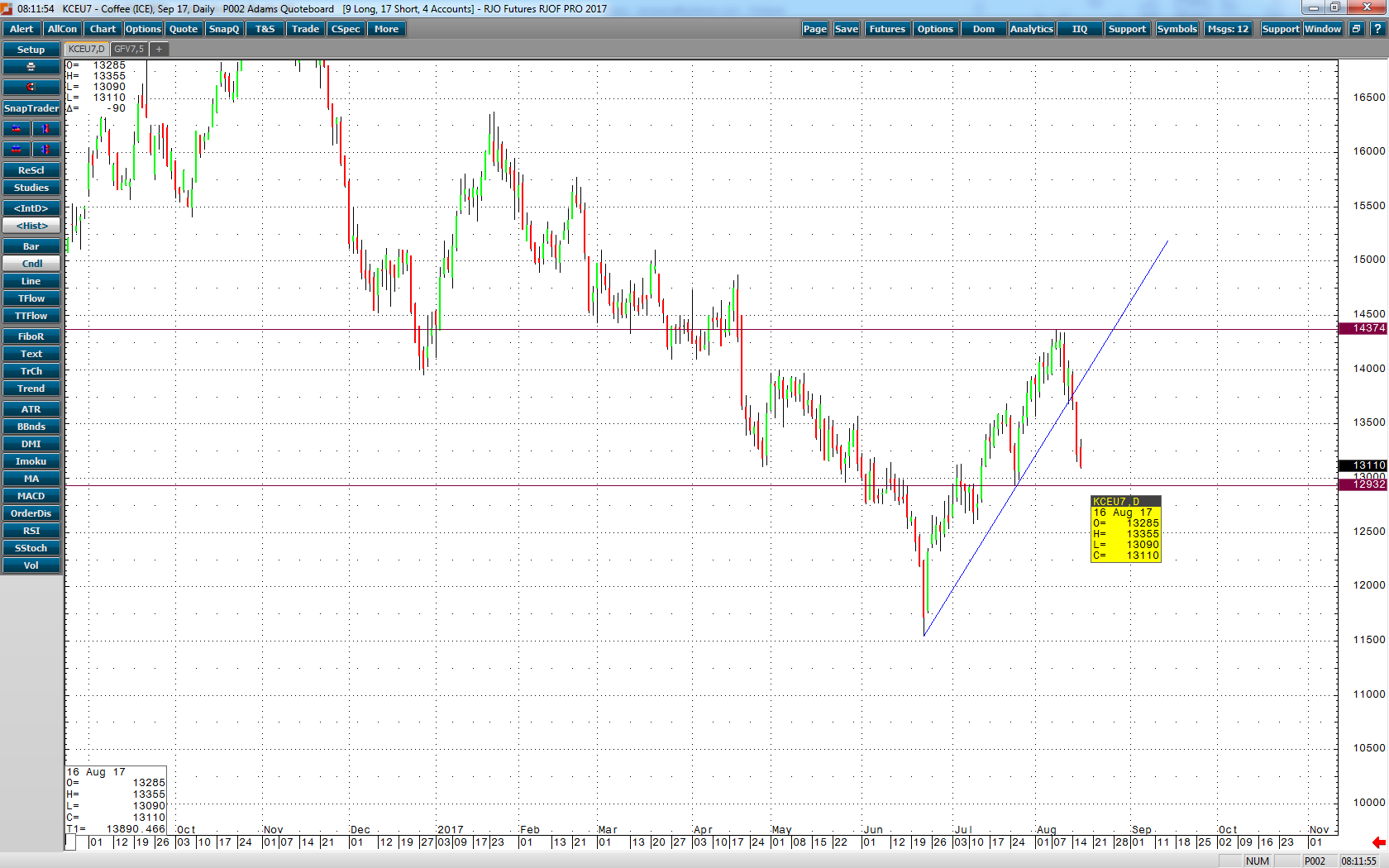

On the daily chart of September coffee below, we can see a clear violation of the trendline that has been in place since June 22. Although trendlines do not provide perfect entry and exit levels, they do provide a valid and honest glimpse of threshold violations, which should never be taken lightly. From a risk-reward perspective, a short position would be advised with a violation of the 12932 critical support area. Be patient, wait for this violation to take place, then jump in.

Sep ’17 Coffee Daily Chart