Global equity markets were higher overnight with the Dow Jones industrial average expected to open 35 points higher. In addition to a generally positive economic environment, the stock market this morning should benefit from news that Chinese automaker Great Wall Motor Company LTD was considering taking an interest in Fiat Chrysler. Another element helping cyclical attitudes in the market came from home builder, Toll Brothers, as their profit rose by nearly 41% off what the company described as an improving job market. Limiting the market on the upside is news that the US administration was planning to commit more troops to the effort in Afghanistan. Unfortunately for the bull camp, evidence of efforts by the US treasury Secretary and members of congress to move forward on tax reform have not been given much mainstream media attention or on might have expected the risk on argument to gain even more strength. As indicated already, the path of least resistance in the September E mini S&P is pointing upward with a series of closes around 2427 representing close in support. However, the strength in prices from yesterday’s lows were not laid at the feet of some specific event and therefore one might assume the gains this morning are merely technical balancing from four days of aggressive selling pressure.

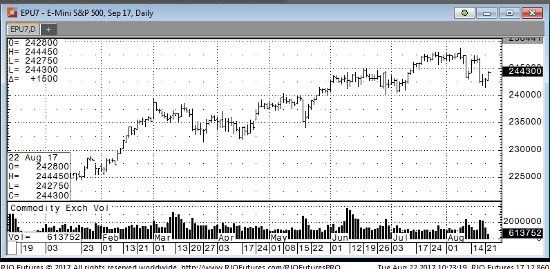

Sep ’17 Emini S&P Daily Chart