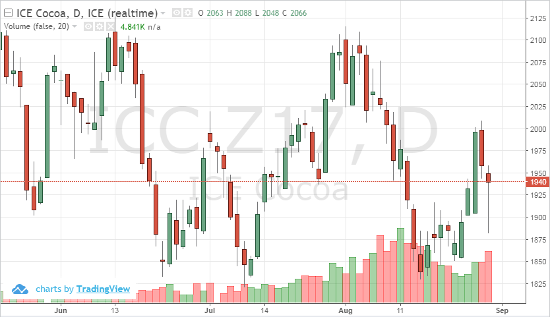

In the front-month cocoa contract, the large supply is reflected in prices and coming to fruition. These large supplies are leading to a sell-off by funds. On the currency side of the trade – the Dollar rebounded, Euro dropped, Pound is weak – risk on is back across the global commodity markets. Gold is trading about $1,300, safe haven trade is on temporarily.

Banks are anticipating a range between 1800-2000 for the rest of the year in cocoa – looking at the technical indicators and the fundamentals (between the abundance of supply and lack of demand) this range looks to be accurate.

The past few weeks the soft markets have been moving directionally off each other due to Hurricane Harvey.

Coffee has mainly been following cocoa. The big question is, will coffee supplies or facilities in the US be affected by the current weather front? Houston, Miami, and New Orleans are reporting no damage to the materials in the facilities, but the facilities cannot be accessed for the time being. There are reports that Vietnam’s exports are moving higher due to this in the short-term. More bags are being estimated from Brazil in Robusta production, up almost 20%. If output is also increased by 20%, this will leave markets to trade in the current range. Technically, coffee is seeing bearish indicators hit. Daily stochastics and closes below the 9-day moving average are negative for the short-term.

Sugar has traded in a tight range, almost unchanged during some trading sessions this week – short cover is most likely the reason. The original move higher on Wednesday was due to largest producing nations providing bullish news, but then the largest consuming nations made the market reverse by providing bearish demand news. Support was given to sugar by carryover from the move higher in gasoline, ethanol, and currencies. The lower tone in crude oil made that news short-lived though, adding to the price range in sugar. Supplies in the coming months appear to be fairly tight according to mill reports, but that news goes towards nothing if we can’t get some bullish demand news.

Cotton continued to move higher as its key growing regions have been affected the most by Hurricane Harvey. October cotton is also following technical trends and broke key resistance as it has moved higher. Fundamental risk and weather premium is leading cotton.

Dec ’17 Cocoa Daily Chart