The short answer is a resounding yes! First of all, the recent technical action is very encouraging for the bulls in the market. While the gold futures were driven to these current levels, solidly above $1,300, primarily on the risk off and “safe-haven” trade, there are always more reasons to own gold than not to own gold. The gold bugs are always bullish. They will tell you, and I happen to agree, that gold is way under valued versus these “crypto” currencies that no one is really certain about who is “mining” the shop. How about geo-political risk? Has there ever been a time of more uncertainty with geo-political tensions? The equity markets are not going to be able to sustain the historical run that they have been experiencing. A real correction in stocks will drive investors towards gold. We are also approaching the time of year when seasonal demand for physical gold increases.

So, yes I believe that the rally in gold does have legs. The market may experience a corrective dip to test the $1,300 level and perhaps even the $1,290 level where a new base should be formed. Another close above $1,310 in the December contract is considered friendly.

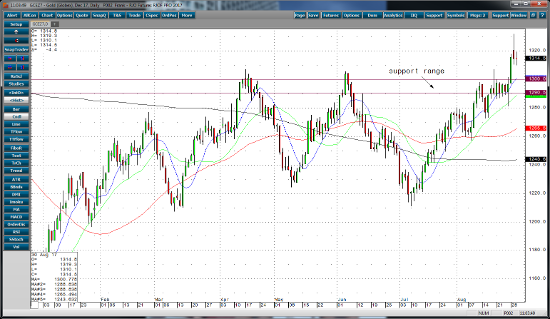

Dec ’17 Gold Daily Chart