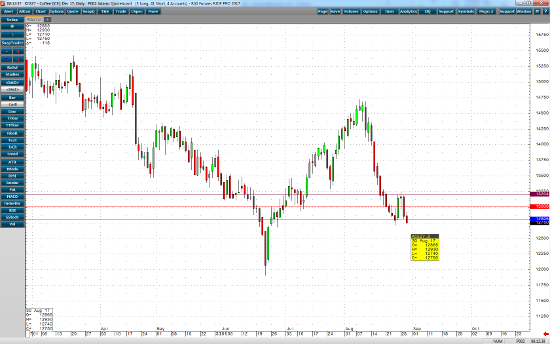

The recent selloff has been a true signal that the strong supply and weak demand fundamentals of coffee continue offer a brittle floor for prices to stand on. December coffee prices are now approaching a sensitive and critical support area of 12715. This is an area that should find solid support, but if violated may result in an aggressive (and possibly massive) selloff back down to the 120 range lows of June. From an intermediate trend perspective, this technical trader believes that those who are interested in catching a large potential move should consider using sell stops to enter the short side below the aforementioned 12715 area. If the dragon is going down in flames, might as well ride it. Don’t just consider futures as your only option, a wise trader will also use options to manage risk and gain exposure.

Dec ’17 Coffee Daily Chart