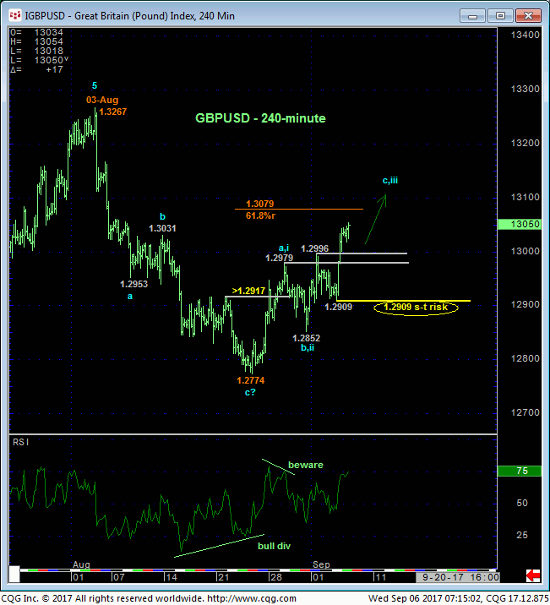

Yesterday’s break above Fri’s 1.2996 high reaffirms our 29-Aug Technical Blog call for a corrective rebound or resumption of this year’s major bull and leaves yesterday’s 1.2909 low in its wake as the latest smaller-degree corrective low the market is now required to sustain gains above to maintain a more immediate bullish count. In this regard 1.2909 is considered our new short-term parameter from which the risk of cautious bullish exposure from 1.2875 OB can be objectively rebased and managed. Former 1.2975-to-1.2995-area resistance would be expected to hold as new support if something bigger is brewing to the upside.

From a longer-term perspective the prospect that 2017’s rally from 1.1988 to 03-Aug’s 1.3267 high is a complete 5-wave Elliott sequence has been well documented. This count warns of a broader peak/reversal process that would be expected to include exactly the sort of corrective rebuttal to Aug’s 1.3267 – 1.2774 initial (A- or 1st-Wave) decline that we’ve witnessed the past couple weeks. But if this rebound is a (B- or 2nd-Wave) correction within this peak/reversal process, then somewhere between spot and 03-Aug’s 1.3267 high the market’s got to stem this clear and present intermediate-term uptrend with a bearish divergence in momentum. Herein lies the importance of former resistance-turned-support around 1.2975 and certainly yesterday’s 1.2909 corrective low and short-term risk parameter. Until and unless such weakness is proven, there’s no way to know that 2017’s major uptrend isn’t resuming to eventual new highs above 1.3267. And the Fibonacci fact that Aug’s sell-off attempt stalled at the exact (1.2778) 38.2% retrace of this entire year’s 1.1988 – 1.3267 rally would seem to be consistent with such a bullish call.

The rate of ascent has clearly slowed on a weekly log close-only basis above, but follow-up proof of weakness below 18-Aug’s 1.2876 low weekly close (below 24-Aug’s 1.2774 intra-day low and new long-term risk parameter) is required to CONFIRM the momentum failure to the point of long-term bearish action.

On an even longer-term scale in the monthly log chart below, this year’s recovery attempt still falls well within the bounds of a major bear market correction. And if this is the case then we would expect monstrous former support from the 1.35-to-1.38-area from 2009 through the first half of 2016 to now contain this recovery as resistance. Until this market weakens below at least our long-term risk parameter at 1.2774 however, traders are advised not to underestimate this market upside potential within the context of a major, multi-year base/reversal process that basically contends that 16Jan17’s 1.1988 low ended the secular bear market and that sterling is in the early throes of a new secular bull.

These issues considered, a cautious bullish policy and exposure remain advised with a failure below 1.2909 required to threaten this call enough to warrant moving to a neutral/sideline position ahead of a prospective move to a bearish policy. In lieu of such sub-1.2909 weakness further and possibly accelerated gains should not surprise with former 1.2995-to-1.2975-area resistance considered new near-term support.