European cocoa demand is on the rise. The British pound made a new one-year high. These two factors will help cocoa move higher and could lead to the market to trade back in the 2000-2100 range. There is growing concern that production levels in West Africa may be lower than anticipated all season. Wet weather may have damaged crops and have caused concerns that black pod disease may be on the rise. West Africa saw a damper summer and some analysts are anticipating a drop in production for the last quarter of the year by almost 20%. As we head into the final quarter of 2017 and move into holiday season, chocolate companies’ demand outlook could affect prices in the futures.

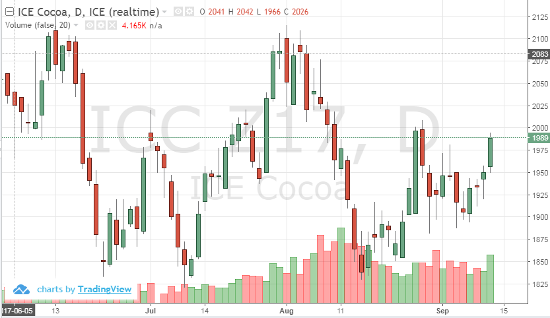

Technically, in the short-term, the close below the 9-day moving is a positive indicator. The close below the 60-day moving average is also a positive long-term signal. 1995 in the December contract will be resistance, above that 2015. The market continues to find support around 1950.

In the near-term, watch weather patterns in Ivory Coast, European demand, and Indonesia’s import patterns.

Dec ’17 Cocoa Daily Chart