This Wednesday, the Fed confirmed my predictions that rates would remain unchanged, and that they would begin rolling back the 4.5 trillion in stimulus accumulated on its balance sheet during the QE program. My recommendation, noted in my last article, to start accumulating short exposure in treasuries has also proven to be quite prescient, as bonds have dumped from two weeks ago.

Although the rollback of the balance sheet was expected, the details were unknown. Instead of reinvesting all the proceeds of its massive bond portfolio, the Fed will allow $10 billion to roll off at first, increasing quarterly in $10 billion increments until the total hits $50 billion starting in October 2018.

Regarding the outlook for the economy, the FOMC has increased expectations for growth from 2.1 percent GDP, to 2.2 percent this year. At the same time, the Fed reduced its outlook for inflation, cutting its expectations from 1.7 percent this year to 1.5 percent, and from 2 percent to 1.9 percent in 2018. The Fed doesn’t expect to reach its 2 percent inflation target until 2019, with low wage growth being the main culprit.

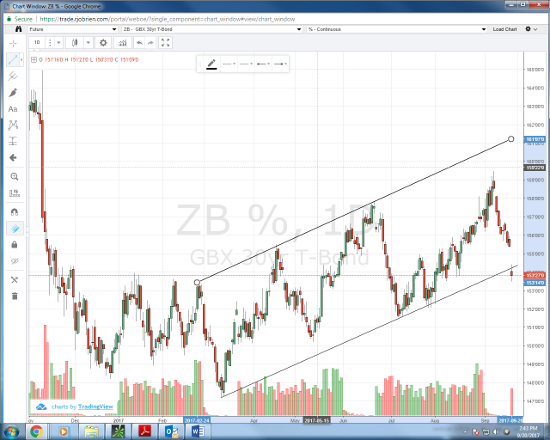

30-year bonds have been trading in an upward channel since March, and it looks like today’s session may have breached the lower trend line of the channel. This bears watching as it could potentially be the beginning of longer term weakness. I would consider holding any short exposure for the time being and seeing how the market closes on a weekly basis.

30yr Treasury Daily Chart