With battle lines drawn over the 50.00 handle in front month WTI crude oil futures, the market has entered a daze, trading in tight ranges waiting for a reason to move. Gasoline refining has picked up pace, with the futures market reflecting a return of refinery margins to pre hurricane levels. Crude oil inventories were reported by the EIA Status Report to have increased by 4.6 million barrels, making the third week in a row of building stockpiles (5.9 million barrels reported last week). With refineries back online, the bid for crude oil has returned and the WTI crude futures has remained well supported above the 50.00 into late September.

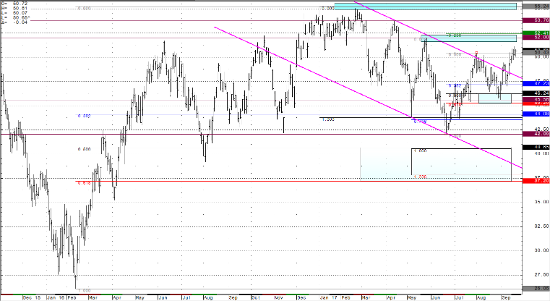

From a technical perspective, front month crude oil futures have broken above trend line resistance at the 49.00 handle (as seen on the chart below), and have held technical 50% Fibonacci support (drawn from the June lows to August Highs) at 46.24. This is constructive price action for bulls, as a clear big has returned to the market as US refineries first protect their margins (even before being able to turn their refineries back on) by buying crude oil futures, and second as real consumption of crude begins when those refineries get back to work. The second windfall of crude buying has occurred, and even though there was a net gain to stockpiles this week, I see this as a trailing indicator to the weather effects of the last four weeks. Continued recovery in damaged regions should also spur additional consumption of fossil fuels, and in turn, demand for crude.

The true test for resistance will be on a sustained break and close above the 50.43, which will immediately put the 55 handle highs from the beginning of 2017, back into the scope for bulls. Without a doubt, WTI crude futures are still in a range from 42.00 to 55.00 over the last year of price action, however, the current trade is taking the market higher in this range for the time being. Every test of the range highs and lows are a chance for a break one way or the other, but until then, we will continue to track the dynamics which are governing the price of crude oil. The figure to watch in the near term remains the 50.00 handle, with more upside.

Crude Light Daily Continuous Chart