December cocoa ended Wednesday’s trading session near the high. The contract has been range bound despite the drop in the Euro and the British pound. The German election has brought some volatility to the currencies. As reports come in for the 2018 crop from Ivory Coast and Ghana, we see that news is mixed. Ivory Coast’s wet weather appears not to have affected future crops for now. Ghana’s production and pod development could suffer due to a drier season. Demand in Europe was unable to sustain a recent increase but forecasts show global consumption should be on the rise. If production comes up high for the 2017/2018 outlook, this data could be a wash.

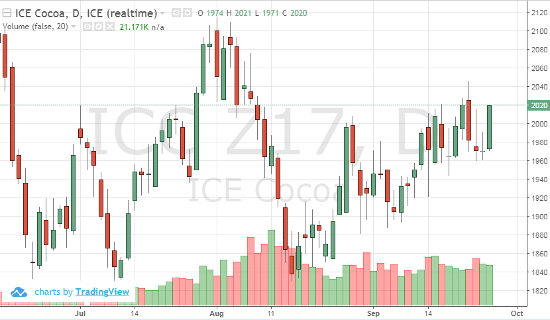

Technically, looking at the chart below, we are sitting at resistance. A break above 2025 and a close at 2060 would push this recent move higher. As the month comes to an end and we receive the COT numbers on Friday, look for cocoa to test 2100.

Dec ’17 Cocoa Daily Chart