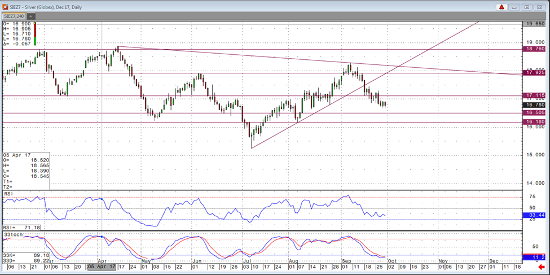

As of now, December silver is trading near yesterday’s lows at the contract’s lowest level since August 17, 2017. A number of bearish factors weighed on the metals this week, including hawkish Fed comments and anticipation of rate hikes. This leads to dollar strength, as well as the easing, or “pricing in”, of North Korean tensions and learning the details of a new tax plan in the US. All of this leads to abandonment of a flight to quality, continuing the recent down move from the recent September 17 high.

On the daily chart, this move could be losing steam as the market meanders between the 17.00 and 16.50 levels, with a narrowing range in the recent days and an outside day yesterday. Even with these factors, a close below the 16.80 defining point could lead to a continuation of this move to the 16.50 level, and possibly continuing to the low $16.10-$16.20 ($16.18 level). On the other hand, with possible end of week profit taking and short covering, as well as nearing oversold levels on the RSI, we could be seeing the beginning of a near term bottom. The decline seems to have stalled and in recent days, as coiling price action prior returns to the $17.10-$17.20 ($17.11 level).

Dec ’17 Silver Daily Chart