Global markets were mixed again with little in the way of geographical patterns. It would appear as if US equities are poised for yet another record high pulse. While the theme of low inflation and low rates for a long period of time remains a key component of the upward track in equities, it would also appear as if recent gains in equities have been the result of rotation and other mechanically healthy developments. However, the bulls need to be on the lookout for any further confirmation of a controlling loss in job sector growth, as growth over the past five months has been sluggish. The trend is up and the stock market appears to have the capacity to embrace positives, and discount most of the negative headline stories. With the slight increase in job sector fears raised over the last 24 hours, investors might take a long look at earnings from Constellation Brands as a fresh reading on the cyclical condition. Uptrend channel support early today is seen at 253150 and resistance is at the latest all time high of 253800. Uptrend channel support into the nonfarm payroll result on Friday morning raised to 253600, and we would suggest that longs tighten up their profit stops.

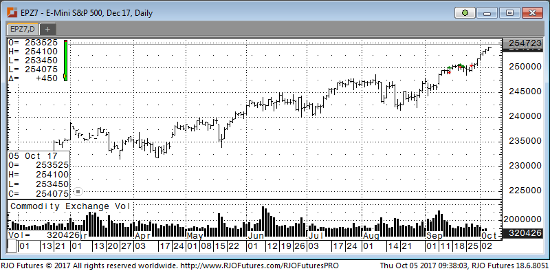

Dec ’17 Emini S&P Daily Chart