The oil market has dealt with a number of conflicting reports this week, although unemployment and Fed speak are having the last word as of Friday morning’s trading. Earlier in the week, Russia’s Energy Minister mentioned no urgency to restructure the current OPEC quota, while OPEC’s secretary mentioned that the current quota compliance was very high. The market also dealt with the fact that refining capacity and demand would be skewed post hurricanes.

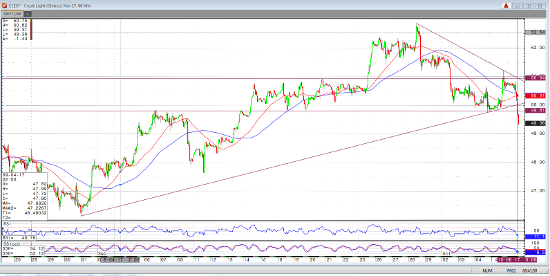

Technically, prior to this morning, oil had hardly been able to trade below $50, $49.80s to be exact, since September 13. In Thursday’s trading, the market traded above the 50 and 100 period moving averages and trend line originating from the August 30 low. As of Friday morning, the skewed unemployment number and the Fed’s Kaplan mentioning a high probability of rate hike, oil has blown through the previously mentioned averages, trend line, and levels. It should be interesting to see if this continues much further past the $49 level or rebounds back to the mid $50s and higher.

It would seem that the hawkish comments following the jobs report have affected the dollar and oil prices.

Nov ’17 Crude Light 60 min Chart