European grindings provided some bullish demand news for cocoa. Support in the market has also been provided by the steady increase in global demand. Throughout this trading year, traders have been focused on the abundance of cocoa being estimated – turns out there is less than anticipated. Ongoing concerns that demand would be down in Europe, the top consumer, turns out to be the opposite. Third quarter grindings showed an increase of 3%. The moves higher in the Euro and pound also supported prices, and this recent move up. Focus will turn to North American numbers and see if this region can help with follow-through as we head into the last leg of 2017 and enter the holiday season.

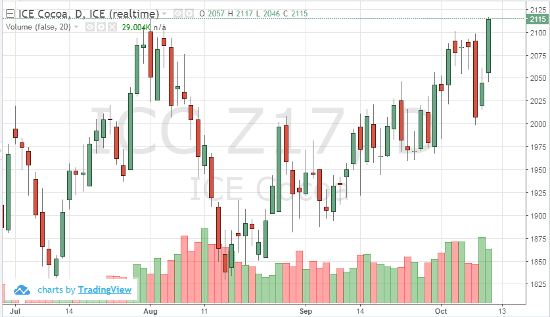

Technically, resistance was broken at 2050 and 2105 – the 200-day moving average was also broken. The market will need to move above and hold over 2125 in the December contract to entice more buyers into cocoa.

Look for the next target, 2200, being touched in the near future as the fundamentals and technicals work together for the moment.

Dec ’17 Cocoa Daily Chart