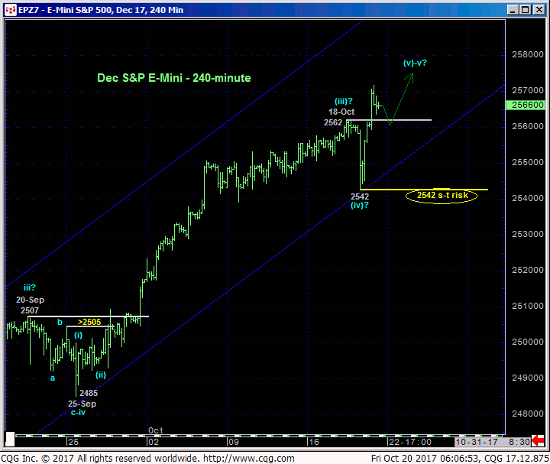

Overnight’s break to yet another new all-time high leaves yesterday’s 2542 low in its wake as yet another smaller-degree corrective low the market is now required to fail below to even defer the bull, let alone threaten it. In this regard 2542 becomes our new short-term risk parameter from which shorter-term traders with tighter risk profiles can objectively rebase and manage the risk of a still-advised bullish policy and exposure. Former 2560-area resistance is considered new near-term support.

By posting another new all-0time high today, the market has once again exposed a condition in which there is no resistance and all pertinent technical levels only exist BELOW the market in the form of former resistance-turned-support and, most importantly, prior corrective lows the market remains required to break to defer or threaten the bull. Above we’ve identified a short-term risk parameter at 2542. Only a glance at the daily log chart above and weekly log chart below show that the MAGNITUDE of even the past couple months’ continuation of the secular bull market requires commensurately larger-degree weakness below 21-Aug’s 2415 larger-degree corrective low and key long-term risk parameter to threaten the major uptrend. For longer-term players setback attempts shy of 2415 remain advised to first be approached as corrective buying opportunities.

In sum, a bullish policy and exposure remain advised with weakness below 2542 minimally required for shorter-term traders to step aside and perhaps for longer-term players to pare bullish exposure to more conservative levels. In lieu of at least such sub-2542 weakness the trend remains up on every scale and should not surprise by its continuance or acceleration.