These two commodities are the first markets I check every morning because they paint the picture of any global overnight developments. Simply put, if copper prices rise while gold futures fall, it’s a sign of a growing global economy whereas if gold futures rise while copper futures fall, it’s a sign of a contracting global economy.

Large movements in either commodity can give clues as to what developments have occurred. An example of a large upward movement in the gold market overnight could indicate heightened geopolitical risks, such as another rocket test fire from North Korea. A large downward movement could be what we saw Thursday, due to an ECB policy change which affects Europe’s economy, causing the dollar to rise and gold futures fall. Copper futures generally make large price fluctuations based on Auto Sales data, considering that global auto sales and production have been rising steadily since 2016. 14% of all copper production makes it way to the automotive sector.

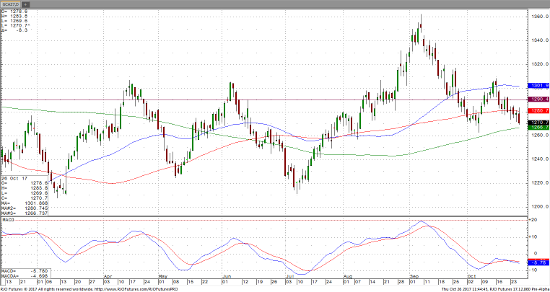

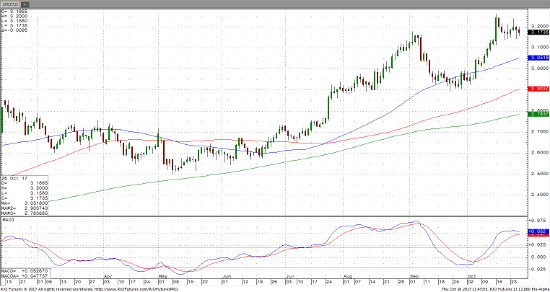

To give you an indication of the performance this year to date, copper futures are up 26%, while gold futures are up 10%. Two price levels and one economic indicator to pay attention to through the end of the week are 1266 in gold (this is the 200-day moving average), a close below this level could indicate the long term trend is turning down. As for copper, a move above 3.26 would indicate a new 52-week high, and a new bull market would take place. According to economic data released Thursday. Gross Domestic Product is the traditional yardstick used to measure the strength of economies, and expectations are for 2.7%. But remember, once the economy becomes too heated, it becomes an inflationary. At that point, you would want to own gold and copper at the same time.

Dec ’17 Copper Daily Chart

Dec ’17 Gold Daily Chart