Overnight’s confirmed bearish divergence in momentum below 19-Oct’s 3.1380 short-term risk parameter updated in Tue’s Technical Blog is of an insufficient scale to conclude anything more than an interim correction of just the portion of the uptrend from 22-Sep’s 2.8940 low detailed in the 240-min chart below. Indeed, the magnitude of the 21-month uptrend from Jan’16’s 1.9355 low requires commensurately larger-degree weakness below at least Sep’s 2.8940 larger-degree corrective low and key risk parameter to break the major uptrend. But with historically bullish sentiment levels even today’s admittedly short-term mo failure must be acknowledged as enough of a deferral or threat to the bull to warrant taking profits on longs from 2.9500 OB recommended in 29-Sep’s Trading Strategies Blog in order to circumvent the depths unknown of a correction OR bigger reversal lower.

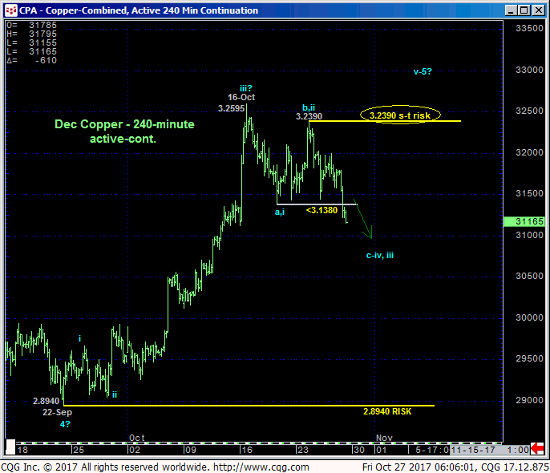

As a direct result of today’s resumption of last week’s initial counter-trend slide, the 240-min chart below shows that the market has identified Tue’s 3.2390 high as the latest corrective high the market must now sustain losses below to maintain a more immediate bearish count. Its failure to do so will render the sell-off attempt from 16-Oct’s 3.2595 high a 3-wave and thus corrective affair consistent with the major uptrend to eventual new highs above 3.2595. Per such 3.2390 is considered our new short-term risk parameter from which non-bullish decisions like long-covers and cautious bearish punts can now be objectively based and managed.

The daily chart above shows the bearish divergence in momentum that breaks the uptrend from 22-Sep’s 2.8940 low. But the SCALE of either a correction or reversal lower is indeterminable at this juncture. This setback could be a minor 4th-Wave correction within a 5-wave sequence up from 2.8940 that calls for at least one more round of new highs above 3.2595. Or that 3.2595 high could have completed a 5-wave sequence from 2.8940 and this setback is a correction of the entire rally from 2.8940 that would call for a steeper correction of this portion of the major bull. Or, finally, and given historically bullish sentiment levels shown in the weekly and monthly charts below, that 3.2595 high could have completed a major 5-wave sequence from Jan’16’s 1.9355 low ahead of a reversal lower that could be massive in scope where even a 38.2% retracement of the 2016-17 rally in terms of both price and time see a decline to the 2.67-area into Jun of next year.

IF the sell-off attempt from 16-Oct’s 3.2595 high is the start of such a more correction or reversal lower, clearly, much more proof of peak/reversal threat behavior is required. A 21-month uptrend doesn’t just turn on a dime, but rather takes weeks of impulsive behavior lower AND, most importantly, proof of labored, corrective behavior on recovery attempts. We’ve thus far only seen one corrective rebound from 3.1380 to 3.2390 and this is of a scale insufficient to conclude a major reversal lower.

The Bullish Consensus (marketvane.net) and RJO Bullish Sentiment Index in the weekly (above) and monthly (below) log scale charts are pinging historic levels that date from 2006. This is exactly the type of contrary opinion levels typical of major peak/reversal processes, and herein lies our rationale for wanting to err on the side of caution and pare or neutralize bullish exposure and policy. These issues considered and while conceding that commensurately larger-degree weakness below 2.8940 remains required to, in fact, break the secular bull trend, traders have been advised to take profits on longs from 2.9500 and move to a neutral-to-cautiously-bearish stance from 3.1400 OB with a recovery above 3.2390 required to negate this call and resurrect the major bull. In lieu of such 3.2390+ strength further and possibly protracted losses should not surprise straight away.