DEC CATTLE

Yesterday’s continued rally above Wed’s 120.475 high leaves Wed’s 118.825 low in its wake as the latest smaller-degree corrective low the market is now required to sustain gains above to maintain a more immediate bullish count. Its failure to do so will confirm a bearish divergence in short-term momentum, complete a minor 5-wave Elliott sequence up from 18-Oct’s 114.525 low and break the portion of the broader bull trend from that 114.525 low. Per such 118.80 is considered our new short-term risk parameter from which traders are advised to rebase and manage a still-advised bullish policy. Former 11-Oct resistance around the 119.15-area stands between that 118.80 short-term risk parameter as a new near-term support candidate we’d expect the market to hold if it’s still technically strong “up here”.

This admittedly tight but objective risk parameter at 118.80 could come in very handy given the market’s engagement of the extreme upper recesses of the 5-month range amidst historically frothy bullish sentiment levels shown in the daily close-only chart above and weekly log scale chart of the Dec contract below. If there’s a time and place for this clear and present uptrend to roll over, we believe it is here and now. And such a rollover threat can first be gauged by the market’s ability to sustain recent short-term gains above 118.80.

Needless to say given the broader 2-month uptrend, a short-term mo failure below 118.80 would be of a grossly insufficient scale to conclude anything more than another interim corrective setback within the major bull. Commensurately larger-degree weakness below 17-Oct’s 116.225 corrective low close (and/or below 18-Oct’s 114.525 intra-day corrective low) remains required to, in fact, break the major uptrend. What the market has in store between 118.80 and 114.50 is anyone’s guess, so if you’re of a risk profile that doesn’t allow for risking bullish exposure to 114.50, we believe your only other objective risk parameter is 118.80. But until and unless this market weakens below at least 118.80, the trend is up on all practical scales and should not surprise by its continuance or acceleration.

In sum, a bullish policy and exposure remain advised with a failure below 118.80 required to threaten this call enough to warrant paring or neutralizing bullish exposure in order to circumvent the depths unknown of a larger-degree correction or reversal lower. In lieu of such weakness further gains remain anticipated.

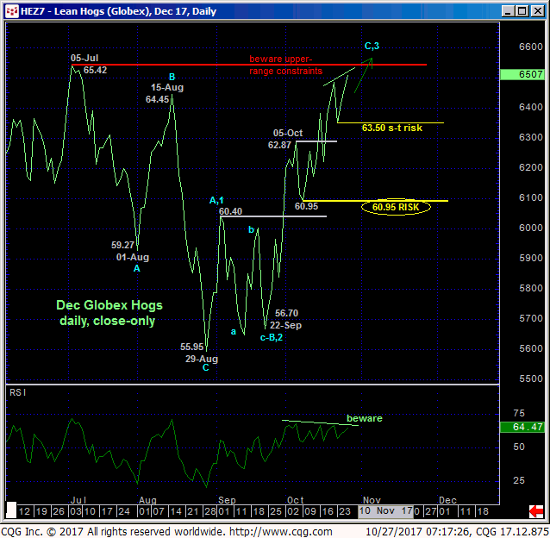

DEC HOGS

The technical construct and expectations for the Dec hog market are virtually identical to those detailed above in cattle with yesterday’s resumed uptrend identifying Tue’s 62.95 low as the latest smaller-degree corrective low and new short-term risk parameter from which a still-advised bullish policy and exposure can be objectively rebased and managed by at least shorter-term traders with tighter risk profiles. A failure below that intra-day low and/or a close below Mon’s 63.50 corrective low close on a daily close-only basis below will confirm a bearish divergence in momentum. COMBINED with the market’s proximity to the extreme upper recesses of the 4-month range amidst historically bullish sentiment level shown in the weekly log close-only chart (bottom), such a short-term mo failure could leave the market vulnerable to a surprisingly deep correction or reversal lower. In lieu of at least such weakness however, the trend is up on all practical scales and should not surprise by its continuance.

In sum, a bullish policy remains advised with a failure below 62.95 threatening this call enough to warrant moving to a neutral/sideline position. In lieu of such weakness further gains remain anticipated with a breakout above 05-Jul’s 65.67 intra-day high exposing indeterminable gains thereafter.