All three major indices are higher early in Friday morning’s trading session. Several factors have contributed to today’s action. For one, the earnings cycle has continued to pump out impressive numbers. A few of the bigger names in equities reported after the bell yesterday and blew it out of the water. Building on Thursday’s post market releases, Friday morning’s GDP number was higher than expected, coming in at 3.0% vs a consensus 2.5%. Higher inventories, strong motor vehicle demand, and strong consumer spending all helped to boost the number. We also saw another solid Consumer Sentiment reading of 100.7. We seem to be making some progress in Washington as the house budget passed, and it appears tax reform has some hope. If all goes well, we could have something done by year end.

These factors have been able to push the Nasdaq to a new all-time high, while the Dow, S&P, and Russell still have some work to do to overtake the highs we saw earlier in the week. Next week’s news slate is absolutely loaded. The two stars of the show will be the FOMC announcement on Wednesday afternoon and the jobs info on Friday morning.

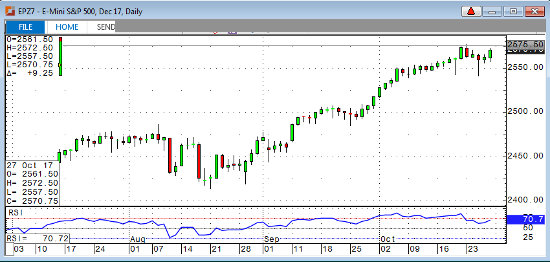

Dec ’17 Emini S&P Daily Chart