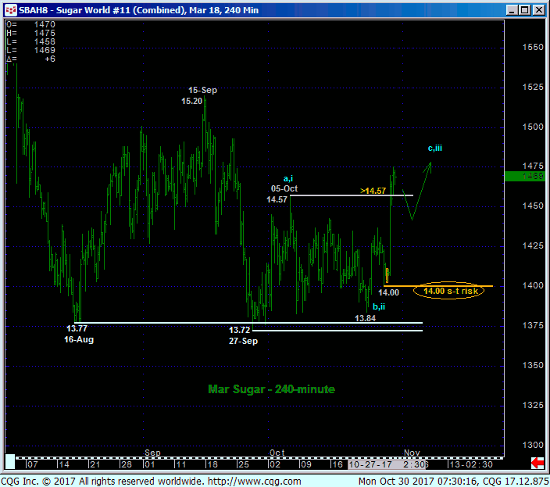

The market’s recovery Fri above our short-term bear risk parameter at 14.57 reinforces the past couple months’ support from the upper-13-cent handle and leaves Thur’s 14.00 low in its wake as the latest smaller-degree corrective low it’s now got to sustain gains above to maintain a more immediate bullish count. Per such, 14.00 is considered our new short-term risk parameter from which non-bearish decisions like short-covers and cautious bullish punts can be objectively based and managed. Former 14.43-to-14.37-area resistance is considered new near-term support.

The potentially compelling thing about this admittedly short-term bullish divergence in momentum is that it comes amidst still historically bearish sentiment levels shown in the weekly log chart below that are typical of major BASE/reversal threat conditions. Such bearishness is understandable and expected given the past year’s major downtrend. And the Mar contract’s position still deep within the middle-half bowels of a 4-month range bounded on the upside by an exact 38.2% retrace of Feb-Jun’s preceding 20.40 – 13.50 plunge would seem to be consistent with a broader bearish count that contends these past four months’ mere lateral chop is corrective/consolidative ahead of the major bear’s eventual resumption.

Another complicating factor in this correction-vs.-reversal debate is the futures contract “roll”. This is always a gray area and perhaps even grayer this time around as a recovery above 01-Aug’s 15.16 high in the then-prompt Oct17 contract would still leave the market below both 20-Sep’s 15.20 high and 01-Aug’s 15.82 high in the now-prompt Mar18 contract. A break above 01-Aug’s 15.82 high would clearly break the major downtrend regardless of contract month and, combined with recent historic bearishness, expose a base/reversal environment that could be major in scope.

In effect then, we believe the market has identified 14.00 and 15.82 as the key directional triggers heading forward. Longer-term directional arguments are valid both ways until either of these levels is broken. Very long-term players remain OK to maintain a bearish policy and exposure, with strength above 15.82 required to negate a bearish count and expose a major bullish one requiring a switch to a new bullish policy. For shorter-term traders however, a cautious bullish policy is advised with setback attempts to 14.43 OB advised to first be approached as corrective buying opportunities with a failure below 14.00 required to negate this specific count and warrant its cover.